TL;DR

- Congress updated the CLARITY Act, excluding developers and DeFi apps that don’t hold funds or control blockchains from regulation.

- Bank Secrecy Act requirements will apply only to centralized intermediaries, exempting decentralized projects from those obligations.

- A formal bill was introduced for the U.S. to create a strategic Bitcoin reserve.

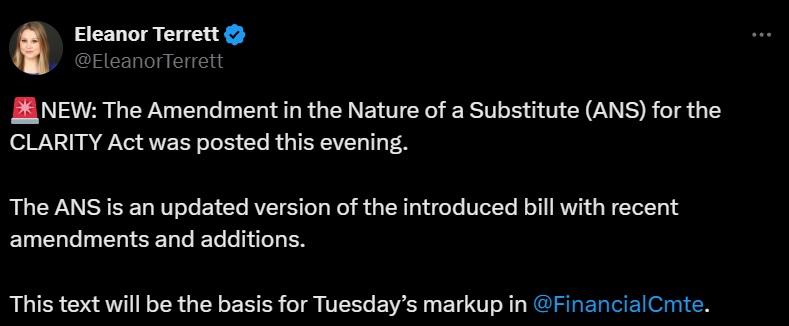

The United States Congress is moving forward in defining a regulatory framework for cryptocurrencies with the release of a new version of the CLARITY Act.

This bill, crucial for organizing the oversight of digital assets, includes changes affecting developers, wallet providers, and decentralized finance platforms. The proposal aims to clearly define which activities will be regulated and which entities will be excluded from the rules applied to money transmitters.

What’s New in the CLARITY Act Draft?

The updated Clarity Act clarifies that developers who neither hold custody of funds nor control blockchains will not be treated as money transmitters, sparing them from operational requirements designed for centralized intermediaries. It also excludes DeFi tools that allow users to keep their own private keys, as long as they don’t directly manage digital assets. This definition protects those building decentralized infrastructure without financial intermediation.

Additionally, the bill establishes that Bank Secrecy Act requirements will apply only to platforms acting as custodians or centralized crypto access points. This means projects operating in a decentralized manner would be exempt, granting greater operational flexibility to both developers and users.

The Clarity Act also introduces a specific section on the use of digital assets by banking entities. The regulation allows nationally and state-chartered insured banks to offer cryptocurrency services and use blockchain technology for legal transactions, provided they comply with existing financial regulations. This enables traditional institutions to incorporate cryptocurrencies into their operations without altering the current banking regulatory framework.

The Bitcoin Reserve Debate Returns

Meanwhile, a separate bill was introduced to formalize a plan for the United States to create a strategic Bitcoin reserve. The proposal, led by Congressman Tim Burchett, seeks to have the federal government begin accumulating BTC as a strategic asset. The initiative has sparked debate, with supporters seeing it as an economic opportunity and critics raising concerns about exposing the state to the volatility of an asset like Bitcoin.

The House Financial Services and Agriculture Committees will review their versions of the bill this week, before merging them into a unified draft