TL;DR

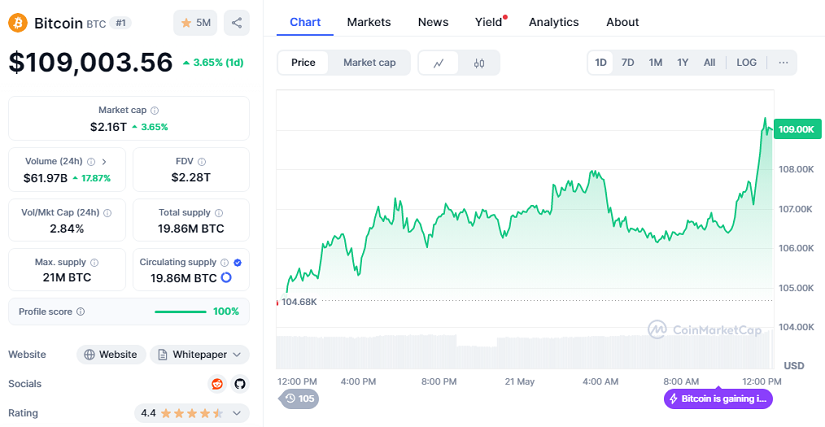

- Bitcoin has just broken its all-time high with a current price of $109,003.56, showing a 3.65% increase over the past 24 hours.

- BTC’s market capitalization has surpassed $2.16 trillion, while transaction volume grew by 17.87% in the same period.

- This milestone coincides with a record surge in the Realized Cap, which now exceeds $900 billion, signaling a strong inflow of institutional capital.

The crypto ecosystem is celebrating a new milestone: Bitcoin has reached a historic price of $109,003.56 (+3.65), surpassing its previous record from December 2024. This bullish momentum has been accompanied by a significant 17.87% increase in daily trading volume, as well as a market capitalization that now hovers around $2.16 trillion. All of this is occurring within a context of strong capital inflows, where the “Realized Cap” — a metric that measures the total value invested in BTC — has surpassed $900 billion for the first time.

Short-Term Investors Ride the Wave of Profits

The main driving force behind this rally has been the optimism of short-term investors, who have seen a significant improvement in their profitability. Over the last month, the percentage of supply in profit for these holders rose by 71%, marking the second-largest increase in history. This translated into $747 million in daily realized profits, adding up to $11.4 billion in just 30 days.

Additionally, the MVRV ratio — which measures unrealized gains — has risen across all investor groups: for short-term holders, it jumped from 0.82 to 1.13, and for long-term holders, from 2.91 to 3.30. These indicators not only reflect the health of the market but also a clear recovery in confidence.

Institutional Capital Fuels Realized Cap Record

One of the most closely watched indicators by analysts and enthusiasts in the sector is the “Realized Cap”, as it reveals how much real investment has accumulated on the Bitcoin network. Over the past month, this value has grown by 4.2%, reaching $900 billion for the first time. This achievement is part of an evolution that has taken the asset from having a “Realized Cap” of just $1 million in 2011 to nearly touching the $1 trillion milestone today.

Although the market is showing signs of profit-taking, the imbalance between supply and demand has not yet been triggered. Tools like the “Sell-Side Risk Ratio” indicate that holders are still not selling aggressively, suggesting there is room for the rally to continue.

This new all-time high not only marks a triumph for early Bitcoin believers, but also serves as validation for the growing wave of institutional investment.