TL;DR

- Harvard analyzed Visa’s patent for a digital fiat currency settlement system using blockchain.

- XRP and XLM are highlighted as leading networks for fast and scalable technical performance.

- This academic recognition boosts their credibility for traditional institutional payment infrastructure.

Harvard University recently examined Visa’s 2020 patent on a digital fiat currency settlement system, pointing to it as a model for blockchain-enhanced money movement. The discussion, shared by crypto researcher SMQKE, highlighted XRP (Ripple) and XLM (Stellar) as the leading networks that align with the patent’s vision for fast and scalable digital fiat handling.

The patent outlines a hybrid framework where central banks convert physical fiat into blockchain-based digital versions. The system combines centralized control with distributed ledgers for efficiency and transparency, preserving fiat’s legal status. It enables approved participants to manage settlements securely, without naming specific blockchains directly.

XRP excels in high-speed settlements with confirmations taking seconds and low fees, ideal for cross-border payments and enterprise use through the XRP Ledger’s decentralized exchange features. Stellar’s XLM focuses on low-cost remittances and accessibility, supporting institutional and individual transfers with reliable throughput, especially in underserved regions.

Academic Recognition Boosts Credibility in Traditional Finance

This academic recognition increases the credibility of XRP and Stellar in mainstream finance, signaling blockchain’s shift from speculation toward infrastructure for global payments. The analysis echoes real-world pilots like Wirex’s Stellar-based settlements with USDC and EURC through Visa, showing practical integration potential.

Visa’s blockchain-based settlement system, detailed in its 2020 “Digital Fiat Currency” patent, envisions central banks digitizing physical cash onto distributed ledgers. The objective targets faster and transparent settlements while maintaining fiat’s legal tender status.

The patent’s mechanics present a central authority converting fiat into blockchain tokens, with validating entities and middleware handling transactions securely among approved participants. The design bypasses traditional intermediaries for near-real-time processing.

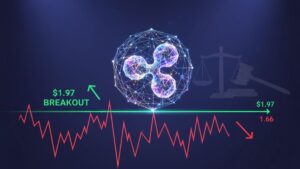

Harvard’s analysis positions XRP as a prime candidate due to the XRP Ledger’s 3-5 second settlements, minimal fees, and scalability for cross-border flows. The network enables Visa-like platforms to replace nostro and vostro accounts without naming XRP explicitly in the patent documentation.

Stellar offers complementary advantages with its focus on financial inclusion and low-value transfers. The network processed millions of transactions for remittance projects in emerging markets, demonstrating capacity for institutional and retail use cases simultaneously.

Ripple’s On-Demand Liquidity using XRP

Although the framework has not been implemented yet, it reflects Ripple’s On-Demand Liquidity using XRP. The similarity could accelerate enterprise adoption if Visa pursues integrations amid growing stablecoin pilots.

Harvard researchers noted the patent’s architecture requires networks capable of handling institutional volumes with rapid finality. XRP and Stellar meet technical criteria for large-scale settlements without compromising speed or cost.

The academic paper arrives as Visa expanded crypto payment tests across multiple blockchains. The company processed over $2.5 billion in stablecoin volume in the last fiscal quarter, validating commercial demand for digital payment rails.

The patent describes security layers where validating entities confirm transactions before finalization. XRP Ledger uses independent validators distributed globally, aligning with the decentralized trust model Visa outlined in the intellectual property application.

Stellar built similar infrastructure with validators operated by established financial institutions. The network anchors stablecoin issuers representing fiat on blockchain, facilitating conversion between traditional currencies and digital assets.

Harvard’s recognition grants academic weight to networks facing regulatory scrutiny. Validation from educational institutions helps separate projects with solid technical foundations from pure speculation in the crypto sector.

Visa’s patent framework allows flexibility in blockchain selection, though the technical requirements favor high-throughput networks with proven track records. Both XRP and Stellar operate production-grade systems handling millions of daily transactions.