TL;DR

- Ethereum’s rally to $4,780 allowed hackers to liquidate stolen cryptocurrencies and secure million-dollar profits in three high-profile cases.

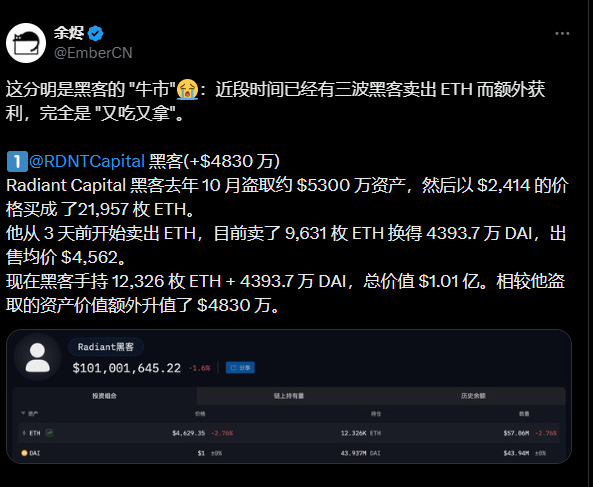

- The Radiant Capital exploit yielded an additional $48.3 million after selling 9,631 ETH while retaining 12,326 ETH, valued at $101 million.

- Over 18 months, crypto attacks caused losses of $3.1 billion in 2025 and $1.49 billion in 2024, highlighting the vulnerability of protocols and custody solutions.

Ethereum’s latest rally has generated unexpected profits for hackers who previously obtained funds through earlier exploits.

ETH’s price surge to $4,780 significantly increased the value of stolen cryptocurrencies, enabling attackers to cash out their holdings for additional million-dollar gains. This phenomenon occurred in three high-profile cases, revealing the vulnerability of DeFi protocols and the rapid appreciation of cryptocurrencies in bullish markets.

Hackers Double Their Stolen Fortunes Thanks to Ethereum

In the first case, the exploit linked to Radiant Capital, allegedly carried out by a North Korean group, had stolen $53 million last October. The hackers converted a large portion of the funds into 21,957 ETH, purchased at an average price of $2,414 per coin, and this week sold 9,631 ETH, obtaining $44 million in stablecoins. After these transactions, they still hold 12,326 ETH alongside the liquidated funds, reaching a total value of $101 million, representing a $48.3 million gain over the original stolen amount.

A similar pattern emerged in the Infini exploit in February, where the attacker acquired 17,696 ETH at an average of $2,798 each after stealing $49.5 million in USDC. The individual laundered 5,000 ETH through Tornado Cash and sold 3,540 ETH for $13 million in stablecoins, generating an additional $25.15 million thanks to ETH’s price increase.

The third case involved an unidentified hacker who stole 17,412 ETH from THORChain and Chainflip in March. They initially sold the assets for $33.9 million in DAI at $1,947 per ETH, repurchased 4,957 ETH at $2,495 in June, and liquidated them this week for $22.13 million at $4,464, earning a profit of $9.76 million.

Security Crisis

These three incidents are part of an 18-month period marked by high vulnerability in crypto market security. In the first half of 2025, attacks and fraud resulted in losses of $3.1 billion, while in 2024 the total reached $1.49 billion. The liquidation data was obtained from on-chain information published by EmberCN.

The situation underscores the urgent need to strengthen security mechanisms in decentralized protocols and crypto custody solutions, as even stolen funds can generate million-dollar profits when prices rise rapidly