Grayscale had a meeting with the SEC about the Bitcoin ETF fund, and a brief on the meeting is now available for the public to read. A 240-day open review period has been established for Grayscale Bitcoin Trust as part of the filing to convert Grayscale Bitcoin Trust to a Spot Bitcoin ETF. The Securities and Exchange Commission has received more than 4,000 comments in connection with this process, which will be taken into consideration by the regulator.

The Stats Are Promising

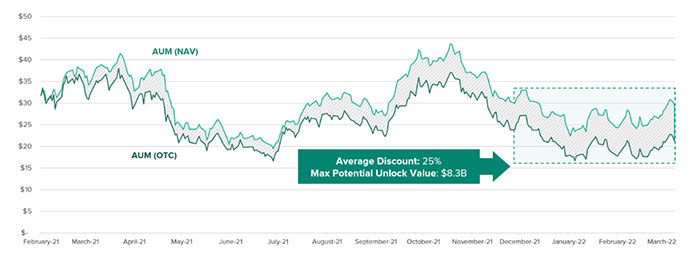

In Grayscale’s report, Grayscale tuvo una reunión con la SEC sobre el fondo ETF de Bitcoin, y un informe sobre la reunión está ahora disponible para que el público lo lea.. According to the article, a large number of Americans are currently investing in digital assets, and this number is continuing to grow. With over 865,000 investors, BTC has grown to become one of the top commodity funds and has become the largest publicly traded digital asset fund. A leading commodity fund by AUM, GBTC is one of the top three commodity funds by liquidity and a top 10 commodity fund by AUM.

In its press release, Grayscale claims to have been collaborating fully with SEC. According to the brief, the company has actively collaborated with the SEC to improve disclosures for the benefit of investors for years. Grayscale’s reporting company products are used by the SEC when they request further information. Grayscale will promptly respond with the additional information, which will then be included in all other SEC filings in order to meet the SEC’s request.

It is worth noting that the most important part of the meeting brief deals with the comments the SEC made about a Bitcoin Spot ETF. The SEC shows discrimination against issuers by approving Bitcoin Futures ETFs while refusing to approve an ETF for Bitcoin Spots.

According to the SEC, the reason why these investment products should be treated differently is that there are distinctions between the ’40 Act and the ’34 Act regarding, in particular, the protection of investors against “fraudulent and manipulative acts and practices. The final distinction Grayscale believes is that there is no difference between ETFs based on futures and those based on options. Furthermore, by approving an ETF based on futures under the ’34 Act, the SEC has been ready to acknowledge that its concerns about the Bitcoin markets, or at least not enough to deny an ETF based on futures, are not legitimate ones.

The Grayscale Group strongly believes in the merits of these arguments and continues to support GBTC’s conversion with the full resources of its firm. There is a deadline of July for the SEC to give its response. Hopefully, the investors’ comments will have an impact on the decision-making process which will be made by the company.