TL;DR

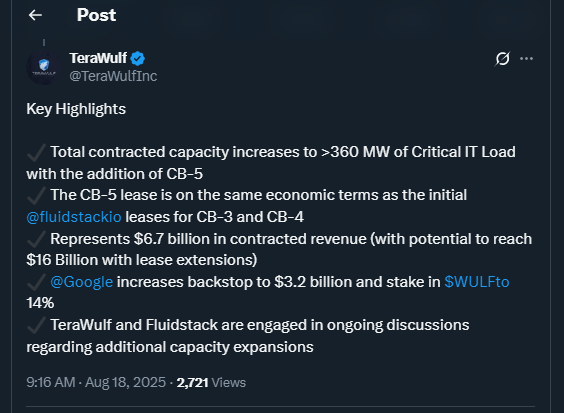

- Google has become the largest shareholder of bitcoin mining company TeraWulf by acquiring a 14% stake through a financial arrangement tied to AI and high-performance computing infrastructure.

- The deal includes a $3.2 billion backstop guarantee supporting a 10-year colocation lease with AI provider Fluidstack.

- TeraWulf continues its Bitcoin mining operations but will increasingly focus on AI and HPC workloads for long-term growth and stable cash flow.

Through the deal, Google received over 73 million warrants, giving it significant influence over TeraWulf’s future. The arrangement ensures that Fluidstack can expand its operations at TeraWulf’s Lake Mariner campus in New York, including a new data center set to open in 2026.

Google’s financial commitment guarantees the lease, covering $3.2 billion if Fluidstack falls short. Executives at TeraWulf view this as a strong endorsement of their zero-carbon infrastructure and hybrid strategy. The partnership also positions the company as a key example of integrating sustainable energy solutions with emerging AI technologies, attracting more institutional attention.

Bitcoin Mining Maintained While AI Gains Priority

After the 2024 Bitcoin halving, mining rewards dropped to 3.125 BTC, prompting companies like TeraWulf to explore additional revenue streams. While Bitcoin mining will continue to generate cash flow, the company now prioritizes AI and high-performance computing contracts with enterprise clients. These efforts aim to stabilize revenue and reduce exposure to the volatility of the cryptocurrency market. TeraWulf’s approach also allows flexible energy usage, balancing Bitcoin operations with AI workloads, which may provide grid support and enhance environmental credibility.

Projected Revenues Highlight Long-Term Growth Potential

TeraWulf anticipates the Fluidstack agreement could produce $6.7 billion in revenue, with potential to reach $16 billion if extended. Industry analysts, including VanEck, estimate that redirecting just 20% of mining power to AI and HPC could add nearly $14 billion in annual profits across major mining firms by 2027. The partnership signals a strategic pivot toward sustainable, high-value operations that combine crypto mining with cutting-edge computational services. The company is also exploring collaborations with additional AI startups, which could further expand its footprint in cloud-based high-performance computing markets.

Following this new announcement, TeraWulf shares surged more than 70% over five days. The move reflects growing confidence in hybrid crypto operations and demonstrates the increasing overlap between blockchain-based energy use and AI infrastructure. Google’s stake not only legitimizes TeraWulf’s model but also positions the company to capitalize on emerging opportunities in high-performance computing. Analysts suggest that this could encourage other tech giants to consider similar investments in crypto-powered AI initiatives.