TL;DR

- An attacker drained $42 million from GMX V1’s GLP liquidity pool on Arbitrum, forcing the suspension of operations on that version and on Avalanche.

- The exploit affected only V1; V2 and its markets remain operational. The attacker swapped the stolen funds for ETH, DAI, FRAX, wBTC, and wETH.

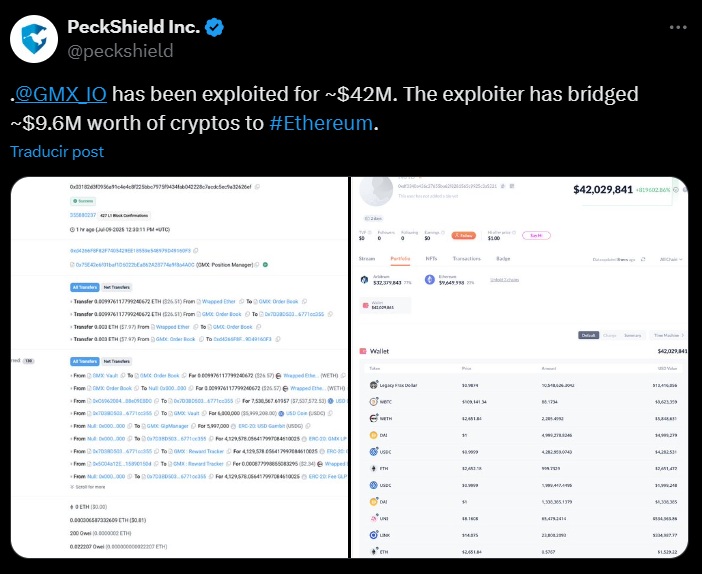

- The GMX token dropped 18% following the attack. PeckShield offered the hacker a 10% bounty and to drop legal action if the funds are returned.

The decentralized exchange GMX suffered one of the largest exploits in its recent history this Wednesday. An attacker managed to drain $42 million from its GLP liquidity pool on the platform’s V1 version running on Arbitrum.

In response, the team immediately disabled all operations on that version, including trading as well as minting and redeeming GLP, on both Arbitrum and Avalanche, to prevent further risks to the platform and its users.

Onchain data shows the attacker swapped the stolen funds first for ETH and then for DAI. They also stole millions worth of FRAX, wBTC, wETH, and other assets. A wallet linked to the attack reportedly holds about $44 million in various cryptocurrencies, according to Arkham Intel records.

PeckShield Offers a Deal to the Attacker

The exploit affected only GMX V1 and its liquidity pool. Version V2, along with its markets and other liquidity pools, suffered no damage. The GMX team is still working on a full technical report explaining the origin of the exploit, but has confirmed that operations on the latest version continue without issues.

As a containment measure, security firm PeckShield posted a message to the attacker acknowledging the GMX V1 exploit and offering a 10% bounty if the funds are returned. The offer also includes dropping any legal actions if the money is returned within 48 hours.

GMX Token Takes a Sharp Hit After the Attack

The market impact was immediate. GMX token price fell about 18% after the attack became known, dropping from $14.42 to $11.78. The platform, which allows trading cryptocurrencies like BTC, ETH, and AVAX with leverage up to 100x, has accumulated over $305.5 billion in volume and $229 million in open interest across 714,348 users since its 2021 launch.

While the investigation continues, GMX works to minimize and contain operational and reputational damage to its ecosystem