TL;DR

- Gemini Predictions launched across all 50 U.S. states after securing a CFTC Designated Contract Market (DCM) license, enabling the offering of regulated prediction market services.

- The platform allows users to predict real-world events, including cryptocurrencies, sports, and global events.

- Gemini aims to build a crypto super app by integrating trading, staking, tokenized stocks, and prediction markets within a single ecosystem.

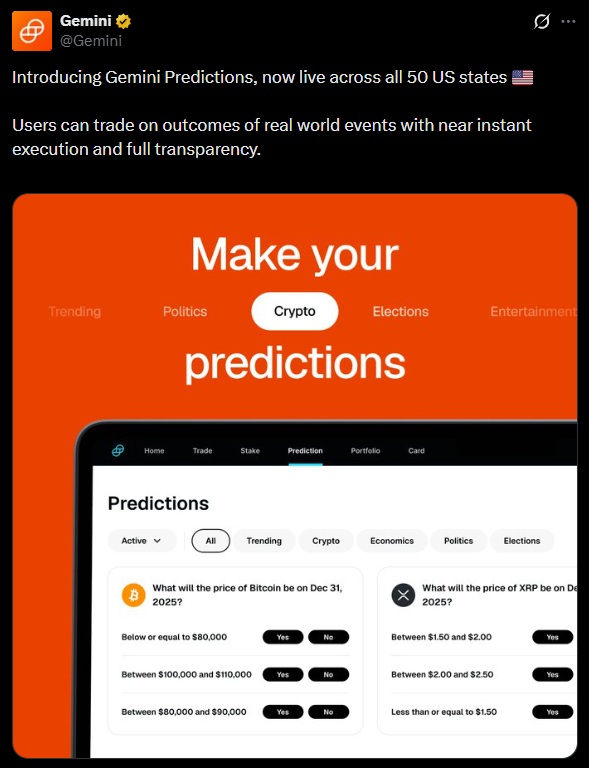

Gemini, the cryptocurrency exchange founded by the Winklevoss twins, launched Gemini Predictions, its prediction markets platform.

The platform has rolled out across all 50 U.S. states. After obtaining the Designated Contract Market (DCM) license from the CFTC, the exchange secured authorization to operate legally in the country, allowing users to predict real-world events with “near-instant execution” and full transparency.

The platform is available through its affiliate Gemini Titan, marking the company’s first step into the prediction markets sector. Gemini Predictions allows users to participate in markets tied to cryptocurrencies, global events, sports, and other specific outcomes. The core of the offering is fast execution combined with a transparent infrastructure that clearly shows how trades are handled.

Gemini Is Building a “Super App”

The launch of Gemini Predictions is part of the company’s strategy to become a crypto “super app.” In addition to cryptocurrency trading, the platform will offer staking services, rewards, tokenized stock purchases, and now prediction markets. The goal is to create a comprehensive system where users can manage their entire crypto portfolio within a single platform.

The project is a direct response to emerging market trends, as crypto platforms converge toward multifunctional services. Competitors such as Coinbase have already begun rolling out similar products, while MetaMask and Trust Wallet are integrating these features into their wallets. PancakeSwap also recently launched Probable, a prediction markets platform on BNB Chain, joining the sector’s rapid expansion.

However, the prediction markets space continues to face regulatory challenges in the United States. Platforms such as Polymarket have had to restructure after facing bans in 2022. Despite recent progress, regulatory guidance on the boundary between betting and prediction markets remains unclear. Some platforms have obtained temporary reprieve following judicial intervention, signaling that regulators may be starting to soften their stance