In a recent tweet, Mike Novogratz, the CEO of crypto platform Galaxy Digital, expressed enthusiasm about the potential of a Bitcoin exchange-traded fund (ETF), after BlackRock filed a registration statement with the United States Securities and Exchange Commission (SEC), seeking approval to launch an ETF on Bitcoin.

The Best Thing to Happen to Bitcoin according to Galaxy Digital

On June 16, Novogratz took to Twitter to reveal his optimism citing BlackRock’s possible ETF launch as “the best thing that could happen to Bitcoin.” Furthermore, in an interview, he claimed that if BlackRock CEO Larry Fink could successfully launch a Bitcoin ETF, it would significantly boost institutional participation in the crypto space and will also drive investors’ confidence in Bitcoin (BTC). The billionaire CEO also highlighted that the uncertainty surrounding the regulatory landscape has slowed institutional flows into crypto.

Fun being on @LizClaman show!! And yes, @BlackRock getting a $BTC ETF through would be the best thing that could happen to $BTC. https://t.co/2fFBeB9eyo

— Mike Novogratz (@novogratz) June 16, 2023

In addition, Novogratz noted the US SEC’s unrelenting clampdown on crypto has forced major companies to move out of the country. He revealed that considering the relocation of Galaxy Digital operations overseas has become “almost essential” to operate without fear of retribution.

He particularly pointed to Hong Kong as a potential destination, signaling a potential shift in how cryptocurrency businesses may respond to regulatory pressure in the future.

Gensler Has Waged a Jihad Against Crypto

The Galaxy Digital CEO pointed to the collapse of FTX under Sam Bankman-Fried as the driving force behind U.S. regulators aggressive stance on crypto specifying, “SBF is going to go to jail for a long time.”

In the recent interview, Novogratz also criticized US SEC Chair Gary Gensler. Taking a jibe at Gensler, Novogratz said the SEC Chair has launched a “jihad against crypto”,making it difficult for crypto-focused companies to operate in the United States.

Despite these challenges, Galaxy Digital sees a silver lining in the resilience of retail investors, who he claims continue to buy cryptocurrencies. This comes following another interview earlier this week where Novogratz noted Galaxy Digital plans to move its operations offshore in the wake of the SEC’s crypto crackdown. He had said,

“Companies like ours are looking at how fast we can move people offshore. The regulatory environment has made institutional crypto a difficult, difficult place to be.”

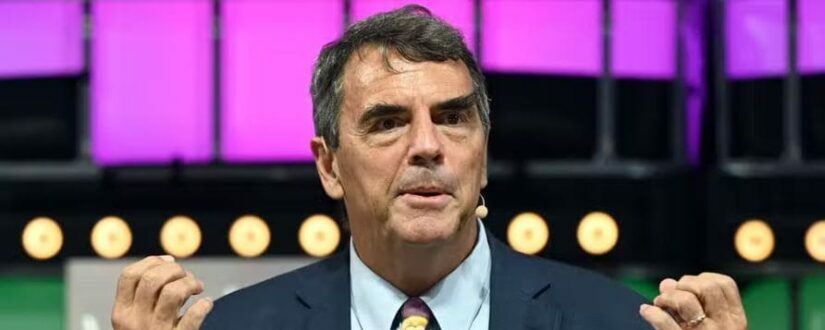

Chiming in along the same tune, prominent VC and Bitcoin (BTC) proponent, Tim Draper called out the SEC, claiming it has been “spreading fear” that has triggered an exodus of innovators. Draper has been vocal regarding the ongoing SEC crypto crackdowns noting the damaging effects of the US policies on the crypto ecosystem as well as innovation in the space. He emphasized that the US regulatory climate is confusing and discouraging the crypto industry from innovating. Draper added,

“If they’re regulating by enforcement, they’re just slapping people down and fining them and suing them. I don’t want to waste years of my life in court and trying to avoid some problem.”

SEC Faces Severe Backlash

Over the recent few months, prominent figures from the financial industry along with notable lawmakers have fervently condemned the SEC’s incessant attacks on the digital assets industry. On June 12, United States Rep. Warren Davidson introduced the “SEC Stabilization Act” into the House of Representatives. One of the bill’s main provisions is to fire SEC Chair Gary Gensler and institute a restructuring of the financial regulator.

Gensler’s SEC wants to brute force crypto into an ill-fitting disclosure framework

In our latest piece, we show why this is a bad policy that fails to give crypto users and investors the info they need, or provide entrepreneurs w/ a viable path to complyhttps://t.co/jOpxYJSl6U

— Rodrigo (@RSSH273) April 20, 2023

Recently, Paradigm, a crypto-focused venture capital firm criticized the US SEC’s attempt to alter the definition of exchange in context with the digital assets industry. The VC firm sent the SEC secretary Vanessa Countryman, blasting the American watchdog’s attempt to redefine the term “exchange”, which seeks to fuse both decentralized exchanges (DEX) and decentralized finance (DeFi) into the definition.

Furthermore, on May 16, United States Senator Cynthia Lummis also slammed Scott Shay, the former chairman of the now-defunct Signature Bank, for trying to place the blame for the bank’s collapse on digital assets without admitting their mistakes. Last month, the United States Chamber of Commerce, which happens to be the largest business organization in the world also lambasted the SEC for its “haphazard, enforcement-based approach” to regulating the cryptocurrency industry.