TL;DR

- Solana is experiencing explosive growth in DeFi, with several protocols surpassing $1 billion in total value locked (TVL), challenging Ethereum’s dominance.

- In Q4 2024, decentralized exchange (DEX) volume on Solana exceeded that of Ethereum, marking a significant shift in DeFi activity.

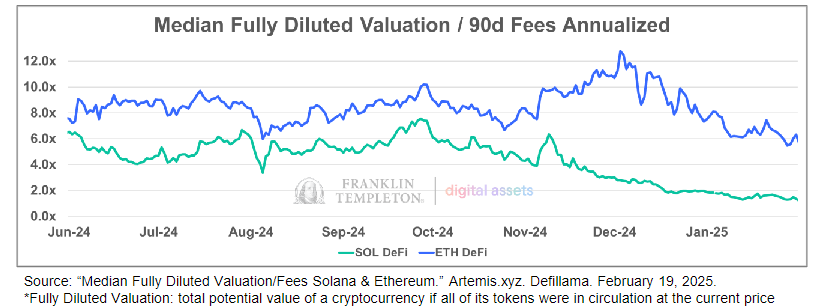

- Despite its growth, Solana’s DeFi tokens remain undervalued compared to Ethereum’s, potentially presenting an investment opportunity.

Over the past few months, Solana has made impressive strides in the decentralized finance (DeFi) sector, positioning itself as a real challenger to Ethereum. A recent report from Franklin Templeton highlights that Solana has outperformed Ethereum in several key metrics and could reach a comparable valuation in the near future.

The report reveals that six protocols within the Solana ecosystem have surpassed the $1 billion mark in total value locked (TVL), with Jito (JTO) reaching $3 billion, an unprecedented milestone for a Solana-based platform. Other notable projects include Jupiter (JUP), Raydium (RAY), and Kamino (KMNO), which have significantly contributed to the network’s exponential growth, attracting increasing institutional interest and retail investors.

An Expanding DeFi Ecosystem

One of the most striking highlights is the transaction volume on decentralized exchanges (DEXs), where Solana surpassed Ethereum in Q3 and Q4 of 2024. This trend is largely due to Solana’s greater efficiency, lower transaction costs, and enhanced scalability, making it an attractive option for developers and investors seeking optimized blockchain solutions.

Another key factor is user activity. By early 2025, Solana registered 26 times more active addresses per hour than Ethereum, indicating sustained growth, strong adoption within the DeFi ecosystem, and a rapidly expanding user base.

Investment Opportunity and an ETF on the Horizon

Despite its growth, the report notes that Solana’s DeFi tokens continue to trade at lower valuation multiples compared to Ethereum’s, despite having strong fundamentals and high growth potential. This could present an opportunity for investors before the market fully adjusts their value.

Franklin Templeton has also made a bold move by filing an application for a Solana ETF with the SEC, which would include staking capabilities, allowing investors to earn rewards by participating in the network. If approved, this could further drive institutional adoption and the ecosystem’s expansion.

While some analysts believe that Solana could eventually challenge Ethereum in the DeFi sector, others point out that it still faces challenges, such as decentralization and broader developer adoption. However, with its pace of innovation and expansion, Solana is proving to be a force to watch in the future of the crypto ecosystem.