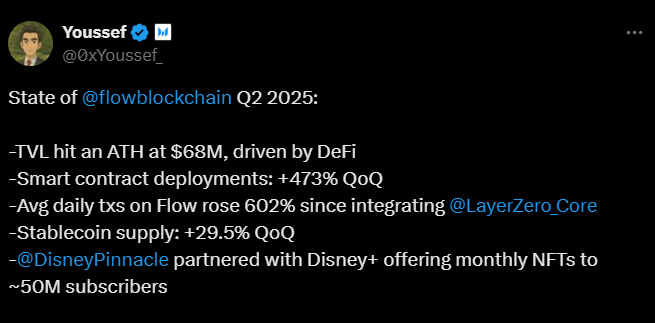

TL;DR

- Flow’s token dropped 13.9% to $0.33, but staking rose nearly 10%, keeping network security participation strong despite the market downturn.

- Contract deployment on Flow EVM grew 473% quarter-over-quarter, with April alone seeing 45,000 new contracts, the highest monthly figure in almost a year.

- DeFi TVL reached $68 million (+46%), driven by KittyPunch and MORE Markets, while PYUSD overtook USDC as the leading stablecoin on Flow.

Flow closed the second quarter of 2025 with results that highlighted a contrast between the decline of its native token and the expansion of its ecosystem.

The token’s price fell 13.9% to $0.33, shrinking its market cap to $522 million. However, the number of tokens staked climbed nearly 10%, reflecting stronger participation in securing the network despite broader market weakness.

Fewer Addresses, More Transactions

Daily transactions held steady at around 277,000, but active addresses dropped 57%. This decline was offset by heavier usage from a smaller base, as the average number of transactions per address rose from 9 to 12.5 over the quarter. Spikes in activity came from specific campaigns, including the launch of Disney+ digital collectibles and several hackathons that drew developers to Flow.

Contract deployment on Flow EVM was a standout metric, jumping 473% from the previous quarter. April alone recorded more than 45,000 new contracts, the highest monthly count in nearly a year. This surge reflects growing developer interest in experimenting with the network, supported by infrastructure upgrades that lower costs and improve Ethereum compatibility.

Flow Rolls Out Key Technical Updates

Notable technical updates included seamless upgrades, preparations for Ethereum’s Pectra upgrade, and the migration to PebbleDB, a database system that reduces memory usage and simplifies storage management. Flow also introduced a mechanism that allows NFTs to retain their attributes when moving between Cadence and EVM, solving several interoperability issues and ensuring royalties are preserved on external marketplaces.

The consumer-facing sector remains central, with collections like NBA Top Shot, NFL All Day, and Disney Pinnacle leading activity. While NFT dollar volumes dipped slightly, activity in FLOW grew 35%, signaling more dynamic usage within the ecosystem. At the same time, the number of sellers declined, suggesting a shift toward long-term collecting behavior.

In decentralized finance, the total value locked in protocols hit $68 million, a 46% increase from the previous quarter. KittyPunch and MORE Markets were the main drivers, while Increment lost ground to these emerging competitors. The stablecoin landscape also shifted with the arrival of PYUSD, which captured two-thirds of circulating supply and displaced USDC as Flow’s dominant asset.