Neo, a community-driven open blockchain network for a smarter economy, is going to launch the first component of its DeFi protocol Flamingo Finance on September 23, 2020. So, what is Flamingo?

Flamingo Finance

Neo describes Flamingo as “an interoperable full-stack DeFi protocol on NEO blockchain”. It is developed under the incubation of Neo Global Development (NGD), the executive arm of the Neo Foundation.

According to Neo, Flamingo will accelerate DeFi adoption by introducing a few missing pieces: a cross-chain asset gateway, an AMM-based on-chain liquidity provision mechanism, and an algorithm based collateralized stablecoin.

Flamingo will feature its own Neo-based project token, FLM NEP-5 governance token, which will be 100% distributed through contribution-based participation from the community.

Neo will start the phased rollout of Flamingo on September 23. Let take a look at some of Flamingo’s features.

Components

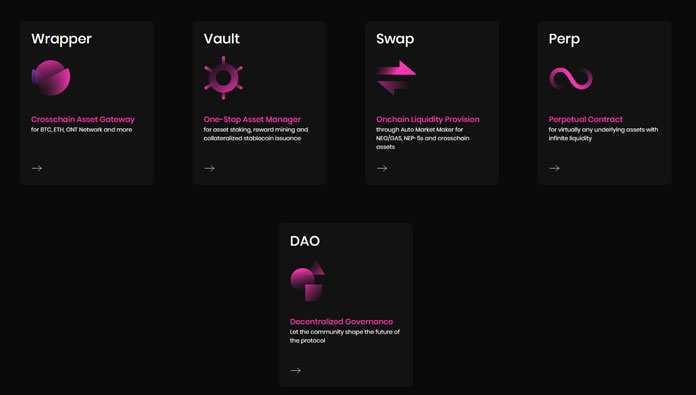

According to Flamingo Litepaper, Flamingo protocol consist of five main components: Wrapper, Vault, Swap Exchange, Perpetual Exchange, and Decentralized Autonomous organization (DAO).

Wrapper

The wrapper is a cross-chain asset gateway based on Bitcoin, Ethereum, Ontology Network, and Cosmos-SDK. In wrapper, users can wrap digital assets into NEP-5 tokens, such as ETH to nEth, NEO to nNeo, and ONT to nOnt. User can also redeem their tokens by returning the wrapped NEP-5 tokens.

The wrapper will be the first component of Flamingo that will be rolled out on September 23. After the launch, users can begin wrapping cross-chain assets.

Flamingo Vault

The vault in Flamingo protocol will be a universal asset manager that combines staking/mining with secured stablecoin issuance. After the launch of the vault, users can stake wrapped assets, and the Mint Rush will begin immediately.

Mint Rush is a special phase designed to incentivize community participation in Flamingo. During this phase, users can stake cross-chain assets, and a total of 50,000,000 FLM will be released.

Users holding whitelisted LP tokens, obtained by providing liquidity, can also mint FUSD, a collateralized synthetic stablecoin in the Flamingo ecosystem pegged to the US dollar, using LP tokens as collateral and receive FLM.

The launch of the vault and the Mint Rush will take place on September 25.

Exchange (Swap)

Swap, just like other DeFi protocols, is an automatic market maker (AMM). It is on-chain liquidity poolfor FLM token, wrapped assets, and other NEP-5 tokens. Like Uniswap, the Flamingo Swap platform uses the Constant Product Market Maker (CPMM) mode to ensure constant liquidity.

Flamingo liquidity will consist of two NEP-5 tokens. Liquidity providers receive an LP token corresponding to their deposited assets. These LP tokens represent the right of liquidity providers to repurchase their assets and receive passive income from trading commissions.

According to Neo, a 100% trading commission will be distributed among liquidity providers. Traders can swap any pair with a trading commission of 0.3%.

The swap exchanger is scheduled to launch on September 30.

Perpetual Exchange

According to LitePaper:

“Perp is an unlimited liquidity provider using AMM’s perpetual exchange for virtually any underlying asset. Similar to the Exchanger, traders can trade perpetual contracts using the same CPMM (Constant Product Market Maker) model with 10x long or short leverage. Traders will use FUSD as a fixed margin and again receive FLM.”

Pricing information will come through the Flamingo oracle. Perpetual Exchange is scheduled to launch on November 25.

DAO

In the long run, the Flamingo project will go entirely to the community in the form of the “Flamingo Improvement Proposal (Flamingo Improvement Proposal) and Flamingo Configuration Change Proposal (and Flamingo Settings Change Proposal).”

Through the DAO, FLM holders can vote on the list of available assets, swap fees, FLM distribution mechanisms, tokens available for staking and distribution, assets available for collateral to issue stablecoins.

DAO will be rolled out on December 23, 2020.

Features of Flamingo

According to Neo, Flamingo combines multiple modules into a comprehensive DeFi infrastructure where users can participate as traders, speakers, and liquidity providers, or play several of these roles at the same time.

Flamingo is an interoperable protocol compatible with various blockchains including Ethereum, Neo, Ontology, and blockchains built on the Cosmos-SDK.

There will be no FLM pre-mining and pre-distribution. The protocol will distribute 100% FLM for work done for the platform. Early FLM distribution is determined by the Flamingo team, but then the DAO will determine the allocation of FLM through voting with FLM.

Important Links

- https://medium.com/flamingo-finance/flamingo-litepaper-%D0%BD%D0%B0-%D1%80%D1%83%D1%81%D1%81%D0%BA%D0%BE%D0%BC-55be101a0bfd

- https://medium.com/flamingo-finance/flamingo-one-pager-f310dab22a4d

- https://twitter.com/FlamingoFinance

- https://flamingo.finance/

If you found this article interesting, here you can find more NEO news