TL;DR

- Bitcoin’s drop shows similarities to past bull market corrections.

- Short-term holder MVRV indicates potential local bottom formation.

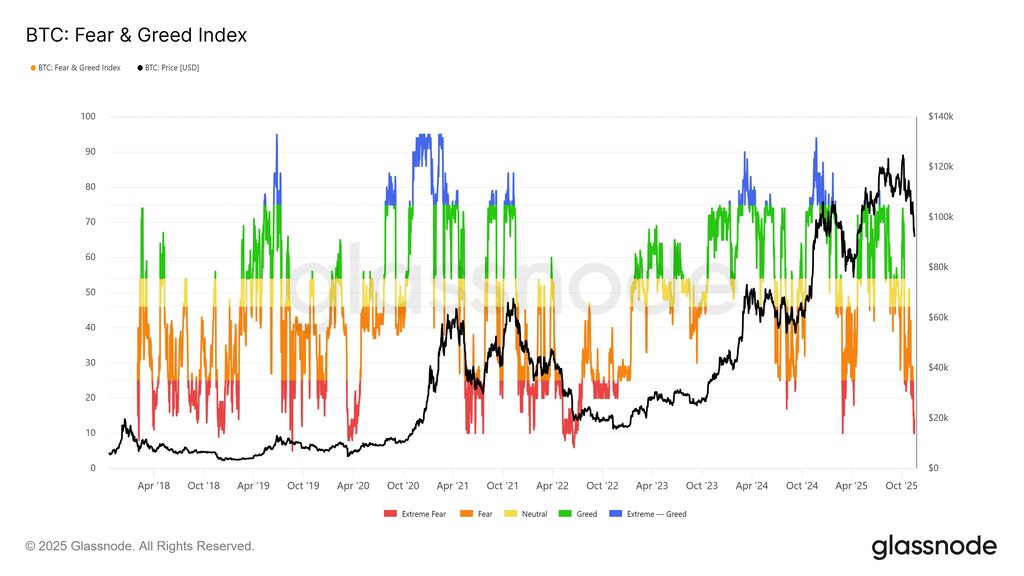

- Fear and Greed Index hits 11, suggesting extreme fear levels.

Bitcoin faces a weekly sell-off that revives debate around a potential local bottom. Chris Kuiper, CFA and VP of Research at Fidelity Digital Assets, states that several on-chain metrics and sentiment gauges look comparable to prior bull-market pullbacks, while noting that certainty never exists in market analysis.

Kuiper explains on X that he monitors Short-Term Holder MVRV together with cost basis. He shares a Glassnode chart that compares BTC with the realized price of short-term holders (STH) and their MVRV ratio, a metric that reveals if STHs sit in profit or loss. Prior uptrends often formed local lows when STH MVRV fell below 1, putting recent buyers in brief loss before price recovered.

Short-Term Holders Under Pressure

Kuiper observes that the current drawdown pushes STHs into loss territory in a pattern resembling earlier mid-cycle retracements. He points out that a 20–30% pullback inside a bullish environment usually forms a similar valley on MVRV, where STHs absorb pressure before momentum resets.

Another key element is the Bitcoin Fear & Greed Index, which moves from extended “greed” and “extreme greed” to readings of “fear” and “extreme fear.” Kuiper stresses that the index tends to reach extreme zones near local tops and bottoms. The index now prints 11, a level tied to a sharp emotional reset after prolonged optimism.

Kuiper adds that he presents probabilities, not forecasts. He underscores that no adverse fundamental shift appears in recent weeks and argues that recent data leans toward a healthy corrective phase inside a broader upward structure.