TL;DR

- The Ethereum (ETH) market shows signs of cooling as it awaits the launch of ETFs approved in May.

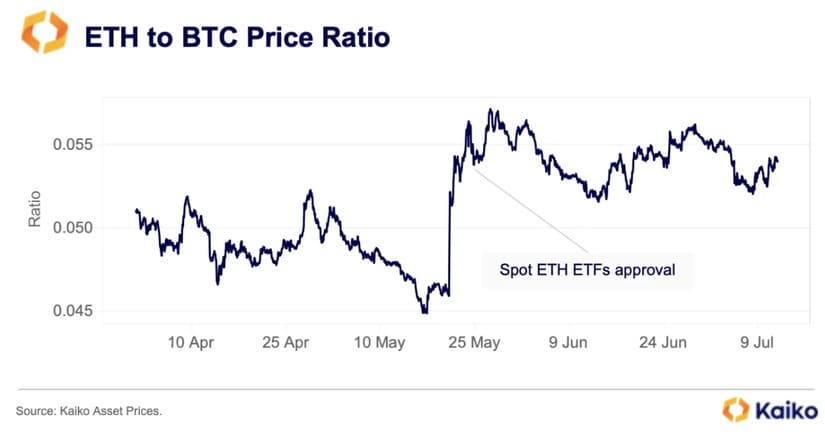

- The ETH/BTC index remains high around 0.05, suggesting ETH could continue to outperform BTC post-ETF launch.

- Liquidity conditions for ETH have remained stable, with a 1% market depth consistently around $230 million.

The Ethereum (ETH) market is showing signs of cooling as it awaits the launch of approved ETFs intensifies. Since the SEC gave the green light to these products in May, the value of ETH has dropped by about 20%. However, despite the decline, the market appears poised for the launch of these new financial products.

The ETH/BTC index, which measures the relative performance between Ethereum and Bitcoin, remains elevated around 0.05, significantly higher than pre-ETF approval levels around 0.045. This indicator suggests that ETH could continue to outperform BTC once ETFs begin trading.

Despite the typical decrease in trading volumes during the summer months, liquidity conditions for ETH have remained stable, with a 1% market depth consistently around $230 million. This marks an improvement from early May levels when market depth was below $200 million. ETFs could further deepen and enhance liquidity conditions, as seen with Bitcoin following the launch of its own ETFs in January.

Ethereum Puts the Market Under Uncertainty

In contrast, ETH perpetual futures markets have shown a more pronounced slowdown. Funding rates have halved since May, indicating less conviction among traders who seem less willing to pay high rates to maintain long positions. Additionally, open interest in ETH futures has decreased from highs of around $11 billion. This situation could be related to uncertainty surrounding the ETF launch date.

Implied volatility (IV) on short-term options contracts has increased significantly in the past week. Ethereum options expiring on July 19 and 26 have experienced the most pronounced changes, with IV for July 19 jumping from 53% to 62% in just a few days. This indicates that traders are willing to pay more to hedge their positions and protect against short-term price swings, reflecting market uncertainty.

On the other hand, Bitcoin continues to consolidate as a safe-haven asset. Several companies have followed the lead of MicroStrategy and Tesla, allocating part of their balance sheets to BTC. This trend has been driven by improved regulation and greater acceptance of BTC as a legitimate investment.

While Ethereum awaits the launch of its ETFs, the market shows mixed signs with a decline in prices but fundamentals suggesting potential strengthening. For now, the launch and its subsequent impact remain to be seen.