The Ethereum price is snapping back to the primary trend after the destabilization of the last few days. Mirroring the performance of Bitcoin, the ETH Price is steady on the previous day, unwinding losses and solidifying the uptrend.

Overly, the path of least resistance emerged as northwards, a net positive for the platform, a short in the arm for network users who coiled back from the untenable high Gas fees.

Addressing Gas Fees

Presently, Ethereum developers are working round the clock for a solution. In the medium term, the Berlin hard fork, completing the Metropolis era, is penciled in for mid-April.

However, the upgrade won’t affect Gas rates. They will remain elevated until there is widespread smooth adoption of Layer-2 solutions like Optimistic Rollups (ORUs) or miners agree on EIP-1559.

The proposal is contentious since miner revenue will free fall, allowing users to determine Gas fees at their expense. Presently, the Ethereum network is overpaying for miners to secure the network.

This is from the high Gas fees, and the millions of dollars in revenue miners rake every month. The next upgrade, dubbed London, will be the beginning of the network fixing high Gas fees.

Layer-2 Solutions

Before then, more projects are willing to either shift to Layer-2 options like Optimistic Rollups and its variants or move to an alternative but EVM-compatible smart contracting network.

The latest DeFi dApp to extend services to the Binance Smart Chain (BSC) is the 1inch Exchange. They aim to emerge as a leading DeFi protocol in BSC while accessing the developed infrastructure in Ethereum.

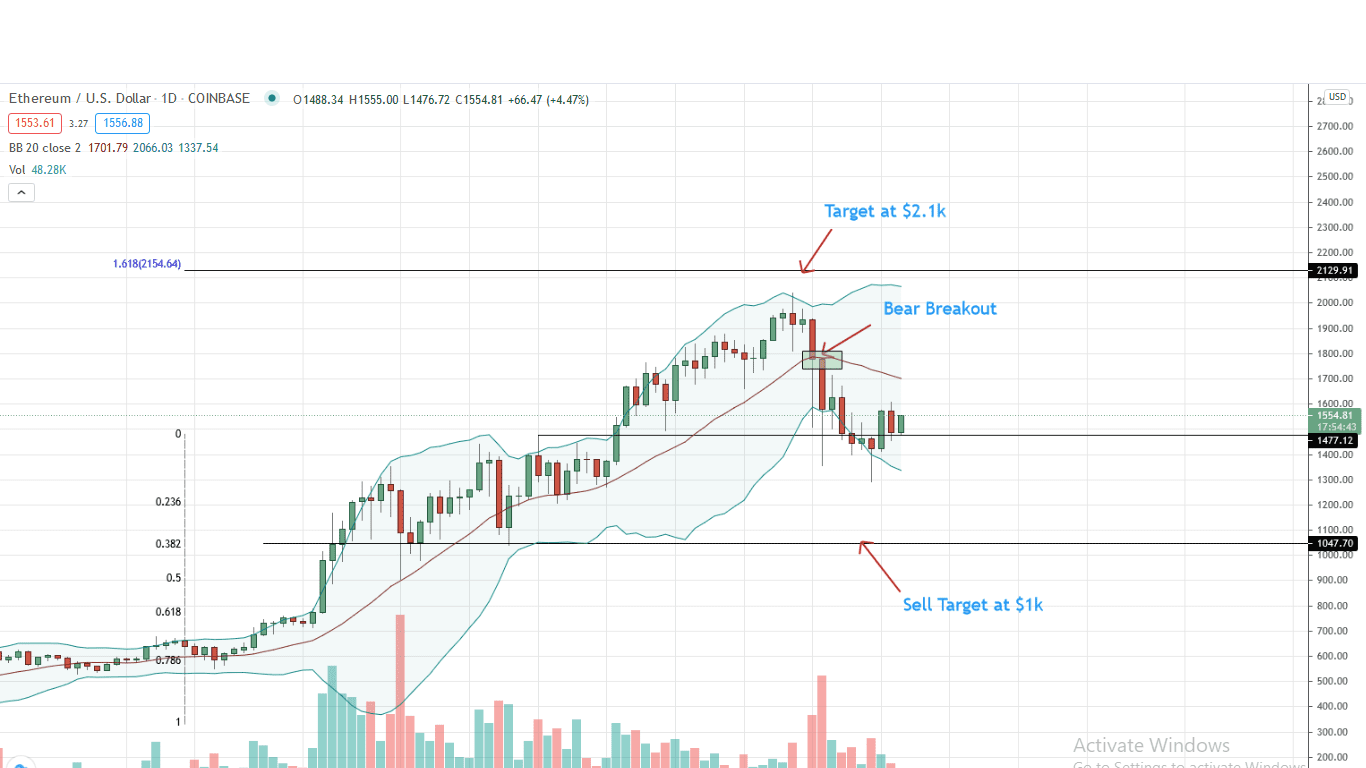

Ethereum Price Prediction

The ETH/USD price is stable and bullish in the immediate term. Despite the optimism, adopting a top-down approach highlights weakness following the end of February free-fall.

From the daily chart, there is a double bar bullish reversal pattern off Jan 2021 highs of around $1.5k. Even though bulls are flocking back, determined to reverse losses, the resumption of buy trend will only be valid once there is a sharp close above the middle BB and $1.8k, or Feb 23 highs. This will nullify bears, setting in motion another rally that may lift the ETH/USD price towards $2k in the medium term.

Accordingly, as long as prices trend above Mar 1 highs, every low may be an opportunity for aggressive traders targeting $1.8k and later $2k.

Conversely, losses below $1.5k may see the ETH/USD price tumble in a bear trend continuation pattern confirming Feb 22 and 23 bear candlesticks.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ethereum News