The latest market cycle has remained volatile. As Ethereum trades below the $3,200 region after Q4 swings, some market commentary has pointed to a shift in attention toward payment-focused crypto projects. In that context, Remittix (RTX) has drawn interest after the project said it launched a mobile wallet on the Apple App Store.

Ethereum remains a widely used settlement layer. However, network congestion, delayed upgrades and competition from payments-focused networks have been cited by analysts as factors that can influence user activity. Market participants also watch for projects that claim near-term product releases, though such narratives are difficult to verify across wallets and trading activity.

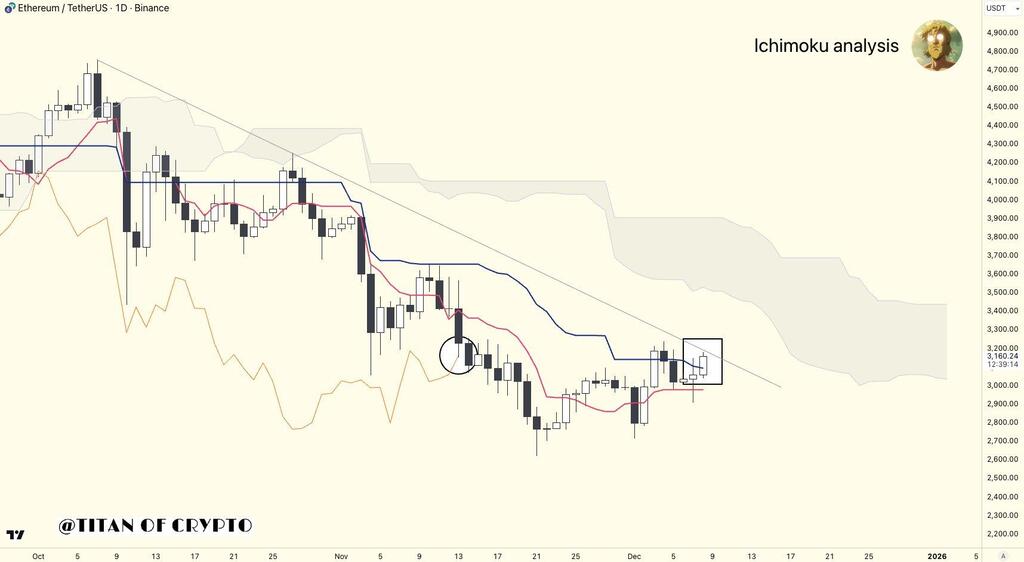

Ethereum price levels traders are watching

Some technical analysts have described ETH as holding above the $2,800 area. Commonly discussed levels in recent commentary include:

- A move above $3,217 as a potential continuation signal toward $3,800

- A loss of $2,800 as a potential move toward the $1,600 area

- A deeper downside scenario discussed by some traders into the $1,200 area

Source: Titan of Crypto/X

Comparisons between Ethereum and newer projects can be difficult because they differ significantly in maturity, liquidity and risk. While Ethereum is a general-purpose smart-contract network, some newer teams are focusing on user-facing features such as crypto-to-fiat off-ramps and payments, which are often provided through a mix of on-chain and off-chain infrastructure.

This is one reason some market participants have begun discussing PayFi-focused projects alongside large-cap assets.

Remittix: PayFi-focused claims and early-stage rollout

Remittix is positioning itself as a payments-focused protocol. Based on project materials and public posts, the team highlights:

- A Remittix wallet listed on the Apple App Store

- A profile on CertiK (rankings and labels can change over time and should be checked directly)

- Funding figures described by the project, including a claim of more than $28.5 million raised

- Planned payments coverage for 30+ countries (as stated by the team)

- FX transparency and settlement claims that depend on counterparties and rails used

- Crypto-to-fiat features described as forthcoming

Some commentators have described Remittix as a PayFi “contender,” but these characterizations are opinions. Claims about reducing reliance on intermediaries and improving off-ramps depend on implementation details, regulatory constraints and third-party service providers.

Publicly identifying “whale” behavior is also inherently uncertain without clear, verifiable wallet attribution.

Ethereum (ETH) and Remittix (RTX): different scopes and risks

| Feature | Ethereum (ETH) | Remittix (RTX) |

| Core Purpose | Settlement layer for DApps | PayFi: crypto-to-fiat payments (project positioning) |

| Current Utility | Smart contracts and DeFi | Wallet and transfers described by the project |

| Constraints discussed by market participants | Congestion and upgrade timelines | Early-stage execution, adoption and counterparty risk |

| Near-term focus | Technical levels such as $3,217 and $3,800 cited in some analyses | Roadmap items such as fiat rails and product rollout (not guaranteed) |

Summary

Ethereum continues to play a central role in the broader smart-contract ecosystem, while newer projects attempt to differentiate through specific products and payments use cases. Any comparison should account for large differences in scale, track record and liquidity.

If ETH breaks above the $3,217 area, some traders would interpret that as a constructive technical signal, though price moves remain uncertain. Separately, interest in early-stage tokens such as RTX can be influenced by marketing, announcements and broader market sentiment, and does not by itself confirm adoption or future performance.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

FAQs

- How do ETH and RTX differ in risk profile?

ETH is a large-cap asset with a longer operating history. RTX is described by the project as early-stage, which generally carries higher uncertainty around product execution, liquidity and market price behavior.

- What is cited as the main reason for interest in Remittix?

Supporters often point to the wallet release and the project’s stated plans for crypto-to-fiat functionality. These claims should be verified through primary sources and independent due diligence.

- Does an audit or verification eliminate risk?

No. Third-party assessments can reduce certain technical risks, but they do not guarantee outcomes and do not address market risk, operational risk or regulatory constraints.

- Can ETH reach a new all-time high soon?

No one can reliably predict that outcome. Market conditions, liquidity and broader risk sentiment can change quickly, and any price targets are speculative.

This article contains information about an early-stage token sale and related project claims. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.