Latest Ethereum [ETH] News

Although progress is slow, we must acknowledge that there is movement and a door of possibilities is now wide open. With foundations laid out with “thirding” and every other adjustment made in Constantinople, Joseph Lubin, the head of Consensys, the software studio of Ethereum, believes the native currency, ETH, stands to increase 1000X in the next two years.

It may be ambitious but when we factor in hard statistics like the number of active developers contributing towards making Ethereum a success and the recent endorsement by the US SEC–that the coin is completely decentralized with no point of failure, and better still steps being made to implement a layer two solution that will once and for all deal with scalability, then we realize that Ethereum is on the brink, a cusp of the next wave of an unstoppable rally that could lift prices to $1,000 or higher within Lubin’s timeframe.

In the meantime, ETH holders at Cryptopia should be ready to accept big losses after the exchange agreed to a haircut distributing their losses with customers albeit on the condition that the exchange was able to recover and secure stolen digital assets.

Since the exchange was literally “owned” with hackers taking advantage of their diverse asset listings and taking control of assets private keys, the platform hemorrhaged for days before leaks were plugged. Unfortunately, it appears that ETH owners won’t receive any reprieve through the fair hair cut and would be forced to bear losses.

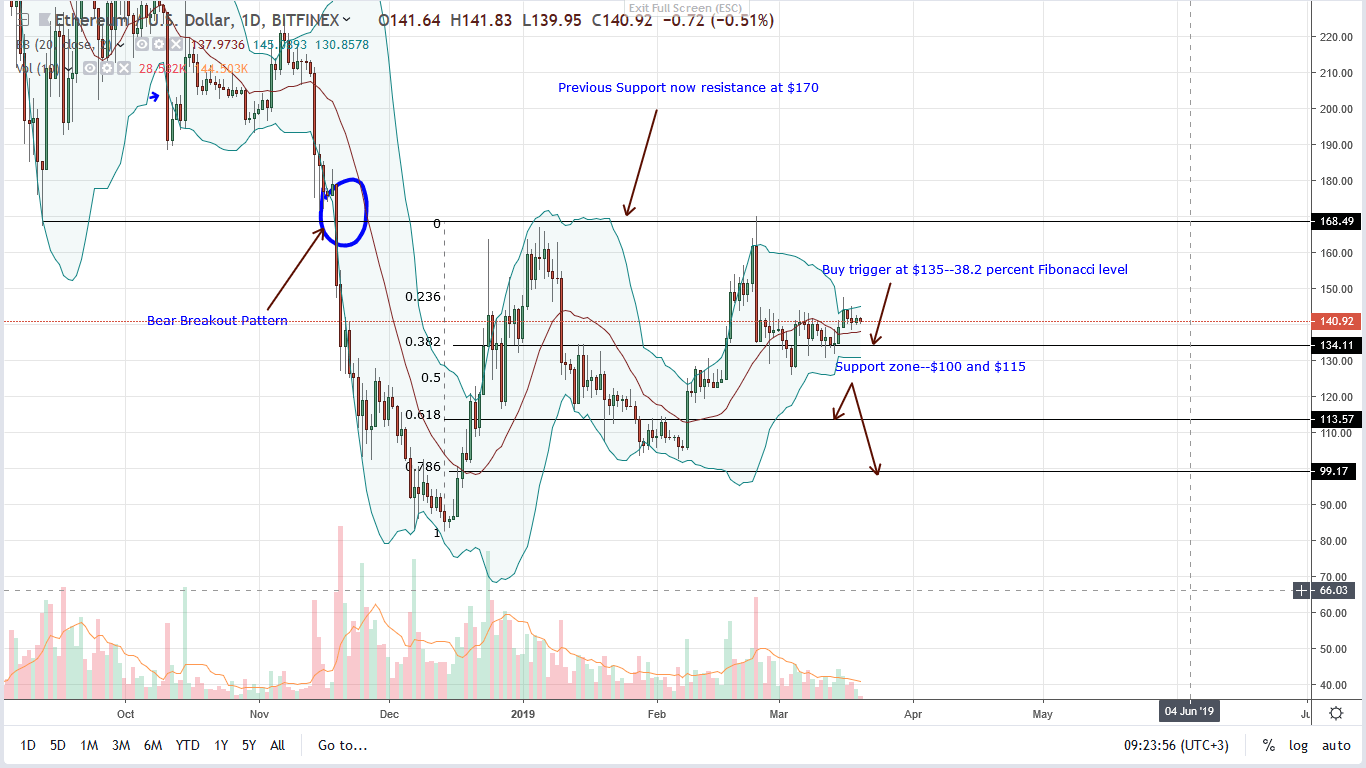

ETH/USD Price Analysis

All the same, ETH prices were largely unaffected and with streams of supportive fundamentals prices are up 3.3 percent in the last week. Even so, the stability in the last few days is a source of concern but as long as bulls maintain prices above $135, buyers stand a chance.

Note that despite our optimism, participation is low, halving from 296k of Mar 5 to 160k of Mar 18. These volumes are dismal and incomparable to the super supply of Feb 24 when volumes average 440k. Regardless, any print above $150 should be preferably accompanied by high transaction volumes exceeding those of Mar 5—300k.

This will provide the necessary impetus and an opportunity for risk-off traders to add to their longs with first targets at $170.

All Charts Courtesy of Trading View—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.