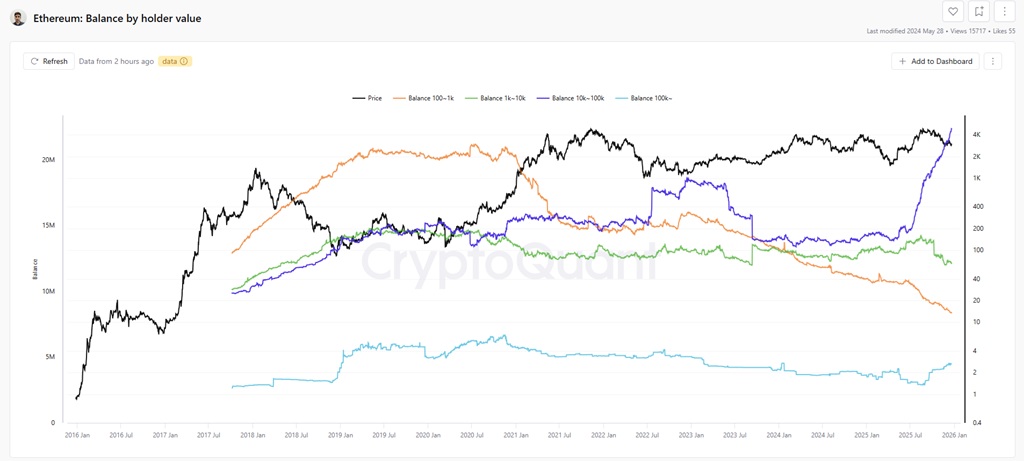

Ethereum recorded an all-time high in whale wallet accumulation. Addresses holding between 10,000 and 100,000 ETH concentrated more than 22 million tokens by the end of 2025, according to on-chain data, marking the highest level of holdings ever recorded for this cohort.

Accumulation intensified during the second half of the year and occurred mostly during periods of token price weakness. Ethereum showed concurrent outflows from exchanges into self-custody wallets, while retail holdings and mid-sized wallets, between 100 and 1,000 ETH, continued to decline. In parallel, derivatives traders reduced their exposure and ETF inflows lost momentum, without altering the pace of whale buying.

This behavior has been key in maintaining a support zone around $2,800 and aligns with a long-term accumulation process. Ethereum retains a central role in DeFi, liquid staking, and stablecoin issuance, use cases that favor large and sophisticated capital structures. The current dynamic points to a less speculative market and a growing concentration of ETH in the hands of investors with a longer-term horizon

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions.