Ethereum (ETH) prices are lower when writing but follows gains from yesterday, looking at the development in the daily chart.

Even with today’s losses, buyers are confident following the welcomed gains on May 23.

Still, despite the breakout above the middle BB on May 23, ETH prices are below $2,000 and the $1,950 liquidation levels.

Even so, ETH bulls can build on yesterday’s expansion as they align with the dominant trend established in Q1 2023 should they shake off today’s losses.

ETH Outflow from Exchanges

This optimism could be valid by looking at on-chain data.

Santiment data reveals that more users are pulling their coins from centralized exchanges like Coinbase and Binance. Ethereum reserves in centralized exchanges stand at an 8-year low, at levels last recorded within the first few months after the Ethereum Genesis event.

Typically, whenever users withdraw assets, analysts interpret it as a positive move that may support prices.

For now, the decentralized finance (DeFi) and non-fungible token (NFT) scene is stable, recovering.

With more users moving to non-custodial wallets, engagement could rise, driving gas demand higher, and supporting prices.

This outflow is amid news that Zilliqa, a high-performance blockchain, is now compatible with the Ethereum Virtual Machine (EVM).

Besides the compatibility advantage, Zilliqa also made the EVM native to its blockchain. As such, users can port assets and applications from Ethereum to the blockchain without changes to the underlying code.

Ethereum (ETH) Price Analysis

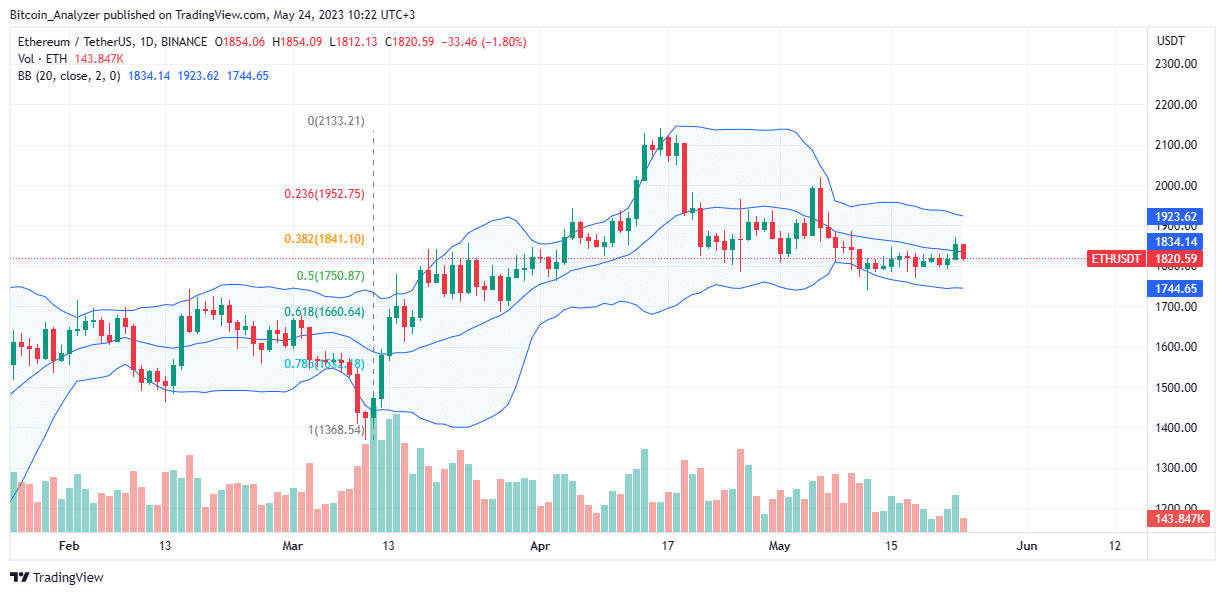

The current trend might be bearish, but bulls from mid-March 2023 define the medium-term formation.

Presently, ETH prices have support at around the 50% Fibonacci retracement level of the March to April 2023 trade range. This reaction line is important and may dictate whether ETH could extend its gains in recovery.

Besides, it is clear that ETH has completed the retest of the February and March highs, validating the bullish breakout of late March 2023.

As such, traders may look to ride the uptrend, expecting ETH to retest $2,100 in a buy trend continuation pattern. The upside momentum could increase if trading volumes rise, driving ETH prices toward key liquidation levels.

If ETH closes higher today, floating above $1,800, the uptrend from mid-March 2023 will likely be in motion.

Conversely, if sellers of earlier today press on, any drop below $1,800 and last week’s loss will nullify this positive outlook.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Ethereum news.