TL;DR

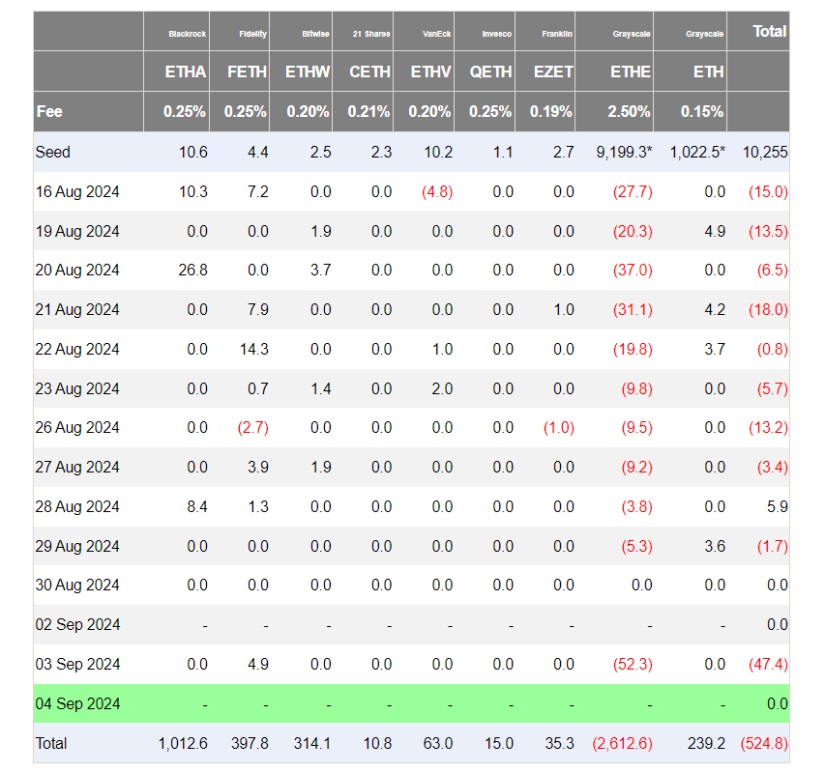

- Ethereum has faced a challenging month following a 30% drop in July, with $476 million in outflows from its ETFs.

- The Grayscale Ethereum Trust (ETHE) unlock and the massive sale of 410,000 ETH by large holders have intensified market pessimism.

- Currently, ETH is priced at $2,485, with a slight daily recovery of 1.9%, but it registers a 12.2% monthly loss.

Ethereum (ETH) has encountered a difficult month after a 30% decline in July, marked by a tepid reception of its exchange-traded funds (ETFs) and significant capital outflows.

Since the launch of the ETFs, approximately $476 million in outflows have been recorded, while Bitcoin ETFs have attracted $3.7 billion in the same period. This disparity highlights a prevailing negative sentiment towards ETH, in contrast to the optimism observed with Bitcoin.

The unlocking of the Grayscale Ethereum Trust (ETHE) has had a strong negative impact on the market, exacerbating the bearish sentiment. Although ETH ETFs were designed to boost institutional participation and stimulate positive price action, the result has been the opposite. The lack of enthusiasm from institutional investors has been a crucial factor in ETH’s stagnation.

Additionally, recent activities by large ETH holders have intensified concerns. In the past week, whales have liquidated approximately 410,000 ETH, amounting to nearly $981 million. This massive sell-off suggests growing pessimism within the market, further pressuring Ethereum’s price downward. The sell-off may indicate a lack of confidence in a near-term market recovery.

Ethereum Needs a 180-Degree Turn to Recover

According to the latest data from CoinMarketCap, ETH is valued at $2,485 and has seen a 1.9% increase in the last day, a slight recovery after falling just above $2,300. The current value shows a minimal positive change of 0.15% over the past week. However, on a monthly basis, the loss amounts to 12.2%, down from a peak of $2,815.

In terms of technical analysis, Ethereum’s price has remained below the critical resistance level of $2,811 since the decline in July, with recent consolidation below $2,546. The stagnation suggests it is struggling to gain upward momentum, which could lead to testing the support level of $2,344 in the short term. The lack of institutional support and widespread bearish sentiment may continue to exert pressure.

However, if institutional investors and whales show renewed interest and ETF inflows improve, the market outlook could change. In such a case, ETH could break through the resistance level of $2,546 and move towards $2,681, turning this resistance into support and paving the way for a potential sustained recovery.