TL;DR

- Ethereum recorded a strong net inflow into decentralized exchanges (DEX), surpassing $166 million in 24 hours.

- Analysts see technical signals, such as an oversold RSI, suggesting a potential 90% rally by mid-2025.

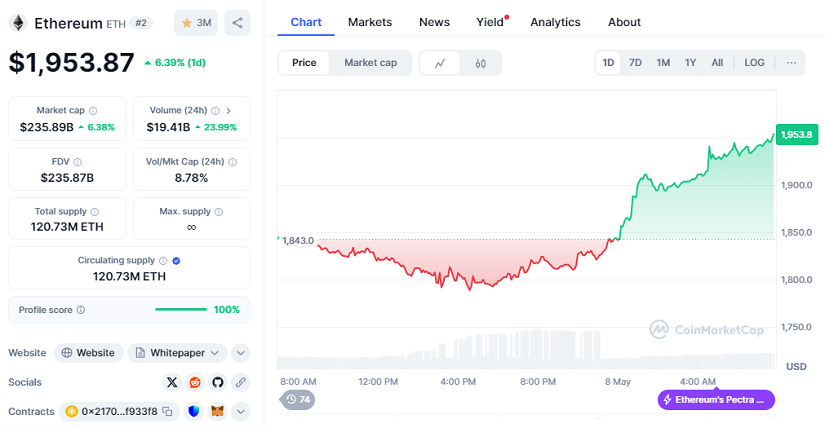

- The current ETH price stands at $1,953.87, with a 24-hour increase of 6.39% and a market capitalization of $235.89 billion, reflecting rising investor confidence and increasing market enthusiasm across the ecosystem.

Ethereum continues to establish itself as the undisputed leader in the crypto ecosystem, especially after the activation of Pectra, which has reignited market enthusiasm. With a market capitalization of $235.89 billion and a current price of $1,953.87, ETH is not only attracting large investors but also positioning itself as the benchmark in decentralized exchanges. Net DEX inflows over the last 24 hours reached $166 million, far surpassing competing networks like Arbitrum and Optimism. This aggressive ETH accumulation reflects renewed optimism from traders eager to capitalize on the next phases of the bullish cycle and consolidate strategic positions for potential future gains.

Oversold RSI Marks A New Recovery Phase

The Stochastic RSI indicator shows that Ethereum is currently in an oversold zone, a technical signal that has previously anticipated strong rallies. According to analyst “Cas_abbe”, when this indicator reached similar levels in the past, ETH experienced gains between 90% and 155% over three to four months. If this pattern holds, the price could exceed $3,400 by July or August 2025. The breakout from the bearish channel that had dragged since January 2025 reinforces this positive outlook, showing solid consolidation near $1,900 that sets the stage for a new bullish breakout toward the $2,500 level, exciting traders and investors alike as they look forward to further upward momentum.

Ethereum Leads Capital Flows As The Market Recovers

ETH’s movement is not happening in isolation: bitcoin has also risen nearly 3% in the early hours of Thursday, approaching the $100,000 mark. This renewed interest is unfolding in a context of global macroeconomic uncertainty, where the Federal Reserve has decided to keep interest rates unchanged, pushing many investors to seek refuge in non-traditional assets like cryptocurrencies. Additionally, geopolitical tensions, such as the threat of renewed conflict between India and Pakistan, are driving demand for digital assets. In this environment, Ethereum stands out not only for its deep liquidity and massive adoption in decentralized applications but also for its ability to remain a leader even in turbulent times. The question now is not if ETH will surpass $2,500, but when it will happen and how the momentum will continue to build.