There are two parts of Ethereum. On one end, developers are hunkering down, hard at work seeking to fully exploit scaling hallways in the base layer. On the other, there are proponents of Eth2, a huge upgrade that affects mode of operations in more than one way.

Vitalik supports both and a few weeks backs actually laid out plan, doubling down on the need of first exhaustively exploiting modes of scaling Eth1 before Eth2 is active.

This way, by the time Phase 1 is live, use of Layer-2 scaling options will be so normal that no one will notice Sharding. Regardless of the path adopted, both Eth2 scaling means and Layer-2 will be complimentary, aiding Ethereum achieve its overarching objective: scalability.

Scaling, as recent developments show, is necessary going forward. In fact, the main driver of ETH prices in the last couple of weeks has been DeFi but the entry is prohibitive considering the inexplicably high trading fees.

The more fees soar, the more roadblocks there are for mainstream adoption and this presents huge challenges. Before Layer-2 solutions gain traction and most DeFi dApps exerting pressure on layer-1 migrate, the Eth2 development team successfully initiated the Zinken test network.

This time, challenges experienced in the first dress rehearsal were addressed and validators launching from different Eth2 clients were smoothly on-boarded.

Spadina had participation errors and the Zinken testnet was meant to iron out issues. That over 66 percent of all validators participated means the network is ready and the users are now waiting for the team to announce the Beacon Chain mainnet Genesis date.

Ethereum Price Analysis

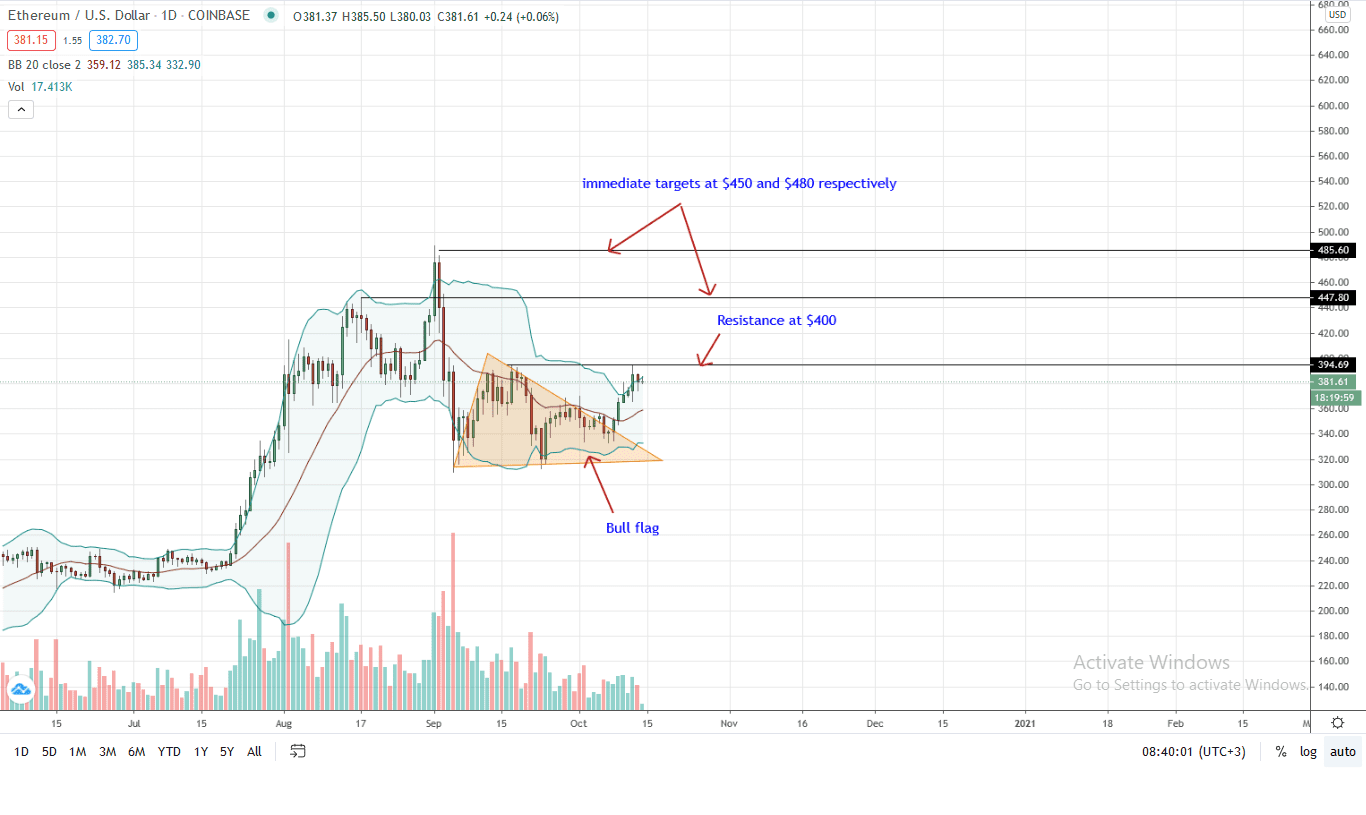

The Ethereum price is bullish, adding an impressive nine percent versus the USD in the last week of trading.

Candlestick arrangements in the daily chart suggest strength. Notably, ETH bulls seem to be aiming for $400—a round number and an active sell wall that may open doors for a re-test of Aug 2020 highs.

After breaking above the bull flag in early Oct, bullish bars are now banding along the upper BB. Noticeably, the upper and lower BB are diverging pointing to volatility. The more bars band along the upper BB with increasing volumes, the stronger the likelihood of a break above $400. The zone between the 20-day moving average and $370 will be immediate support.

A clean break above $400 may likely trigger demand, which may push ETH prices towards $450 and $480. Its rapidity largely depends on fundamentals, which anchor on when the Beacon Chain mainnet will launch.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News