TL;DR

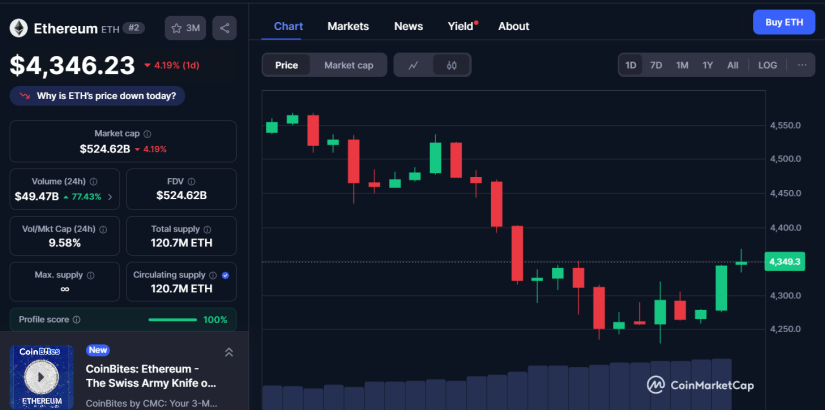

- Ethereum dropped 4.2% in 24 hours to $4,346 after breaking key technical supports and now faces $1.19 billion in liquidation risk.

- The pressure came from higher-than-expected U.S. inflation, reduced odds of aggressive Fed rate cuts, and geopolitical tensions that boosted gold and weighed on Bitcoin.

- Ethereum ETFs saw $152 million in outflows.

Ethereum fell 4.2% over the past 24 hours and is trading at $4,346, hit by a mix of macroeconomic headwinds, technical weakness, and whale activity. The pullback follows a 21% rally over the past month, which pushed many traders to lock in profits.

Ethereum and the Crypto Market Slide Amid GeoPolitical Tensions

The international backdrop played a clear role in the decline. U.S. inflation data came in above expectations, reducing the likelihood of a large September rate cut by the Federal Reserve.

Analysts now expect only a 25-basis-point reduction. At the same time, global uncertainty increased after talks between Washington and Moscow over Ukraine broke down, while Donald Trump’s meeting with Volodymyr Zelensky added further strain. In this environment, investors rotated into traditional safe havens: gold rose 1.2% while Bitcoin dropped 2.5%, dragging Ethereum lower as well.

Technical factors amplified the sell-off. Ethereum broke through key levels around $4,450 and $4,483, erasing its latest bullish structure. Momentum indicators also cooled, with the RSI sliding from overbought territory to 66.7. This setup triggered long liquidations and left $1.19 billion in contracts at risk if ETH falls decisively below $4,400. The next meaningful support sits at $4,180, a level where buyers may step in if selling pressure intensifies.

ETFs Remain in the Green

Institutional flows showed signs of cooling. Ethereum ETFs recorded $152 million in outflows on August 18, contrasting with steady inflows in previous weeks. Adding to the pressure, Ethereum co-founder Jeffrey Wilcke transferred 5,200 ETH—worth $9.57 million—to exchanges. Even so, funds like BMNR and SBET remain profitable, with gains ranging from 13.8% to 22%, suggesting that despite the pullback, institutional positions still hold healthy margins.

The market is now focused on Jerome Powell’s upcoming speech at Jackson Hole. A dovish stance could stabilize ETF flows and help Ethereum regain momentum, while a more hawkish tone on rates could drive the price down toward the $4,180 zone..