TL;DR

- Wallets holding between 1,000 and 100,000 ETH have accumulated 1.49 million tokens over the past 30 days, now controlling nearly 27% of the total supply.

- While retail investors are taking profits, institutional players like BlackRock continue to expand their positions.

- Technical indicators suggest a potential upward move if ETH can break above $2,600 with strong trading volume.

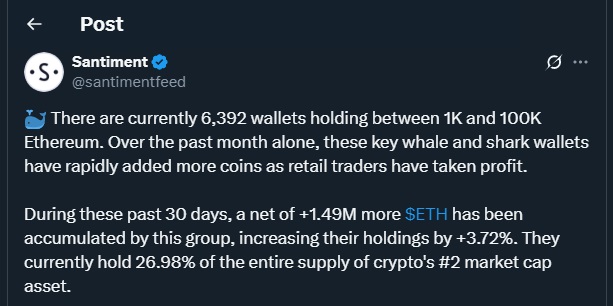

As Ethereum’s price remains in a consolidation phase, whales and sharks have been intensifying their accumulation activity. According to data from the analytics firm Santiment, wallets holding between 1,000 and 100,000 ETH have increased their positions by 3.72% over the past month. This translates to an addition of 1.49 million ETH, equivalent to approximately $3.79 billion.

This behavior is occurring in a context where retail investors have largely opted to take profits. The contrast between the decisions of large and small players suggests a long-term outlook among the former, who now control nearly 27% of Ethereum’s total supply. This marks a significant concentration of coins in the hands of high-net-worth individuals and institutions.

Institutions Strengthen Their ETH Positions

Beyond the spot market, institutional interest has become increasingly evident in Ethereum-linked exchange-traded products (ETFs). BlackRock’s iShares Ethereum Trust, for instance, has added more than $500 million worth of ETH during June alone, raising its total holdings to over 1.5 million coins. Other major players such as Cumberland and Galaxy Digital have also been expanding their exposure, further reinforcing the ongoing accumulation trend by deep-pocketed investors.

This movement coincides with a notable surge in trading activity. Ethereum’s daily spot trading volume has jumped more than 30% in the past 24 hours, reaching $14.27 billion. Meanwhile, open interest in ETH futures is approaching $35.13 billion, suggesting heightened expectations of near-term price action and increased market participation.

Technical Indicators Suggest Potential Upside

From a technical standpoint, Ethereum is trading just below its 20-day moving average, with Bollinger Bands beginning to tighten. This often precedes a breakout, especially if ETH manages to breach the $2,600 level on strong volume. The next key resistance lies around $2,870, and a close above it could open the door to a push toward $3,000.

Momentum indicators are showing early signs of recovery, with the MACD potentially crossing above its signal line. If confirmed, this would signal renewed bullish momentum backed by growing institutional confidence and reduced retail selling pressure.

The behavior of major players reinforces confidence in Ethereum’s fundamentals as a strategic asset in the decentralized financial ecosystem.