TL;DR

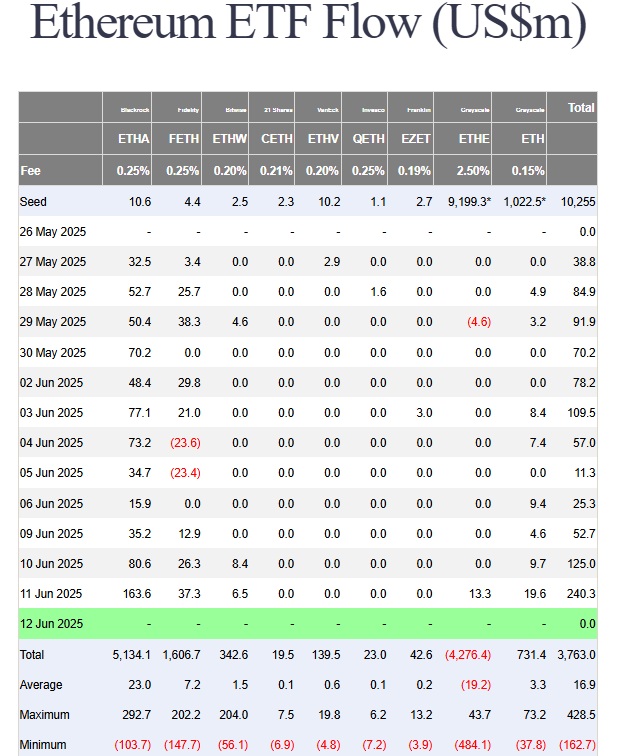

- Ethereum ETFs added $240.29 million in a single day, marking their highest inflow in four months and extending their streak to 18 consecutive sessions of positive flows.

- BlackRock led the buying activity with $163.6 million through its ETHA fund, which now manages over 1.55 million ETH valued at $4.23 billion.

- Ethereum broke a three-year downtrend and activated technical projections placing its next price targets at $3,300, $4,000, and even $13,800.

Ethereum exchange-traded funds (ETFs) clearly outperformed Bitcoin funds after posting $240.29 million in net daily inflows.

It was the highest figure for ETH in the past four months and marked 18 consecutive days of positive inflows for these investment vehicles. This surge coincided with ETH’s price recovery, as it climbed back above $2,800 — a level it hadn’t reached since February.

BlackRock Leads the Crypto ETF Market

BlackRock led the buying through its iShares Ethereum Trust, which absorbed $163.6 million in a single day and completed 23 straight days without outflows. The fund now manages over 1.55 million ETH valued at $4.23 billion. Since its launch in July 2024, ETH ETFs have accumulated $3.74 billion in net inflows.

Institutional interest in Ethereum gained momentum in June, when staking on the Beacon Chain hit a record 34.65 million ETH locked — nearly 29% of the circulating supply. This trend highlights the preference among large holders to keep their positions for the long term rather than sell during periods of volatility.

Recent regulatory changes in the United States and Ethereum’s upcoming Pectra upgrade also supported its recovery. This technical improvement addressed long-standing issues around costs and scalability, reigniting interest from developers and institutional capital. Vitalik Buterin predicted that Layer 1 solutions could multiply processing capacity tenfold over the next year.

Ethereum Breaks Its Downtrend

From a technical analysis perspective, Ethereum broke a downtrend that had capped its price since the 2021 highs. This breakout signals the end of a prolonged accumulation phase that lasted through much of 2023. It also completed an inverse head-and-shoulders pattern on daily charts, with price targets now projected around $3,300 and $4,000.

The similarities between Ethereum’s current performance and the cycle Bitcoin experienced from 2018 to 2021 have caught the attention of the market and investors. Some analysts forecast that if this trend continues, ETH could reach values around $5,900 and potentially surpass $13,800 in later stages of the bullish cycle