TL;DR

- The first Ethereum ETFs in the US debuted on July 23, 2024, obtaining a net inflow of $106.7 million and a trading volume of over $1.1 billion.

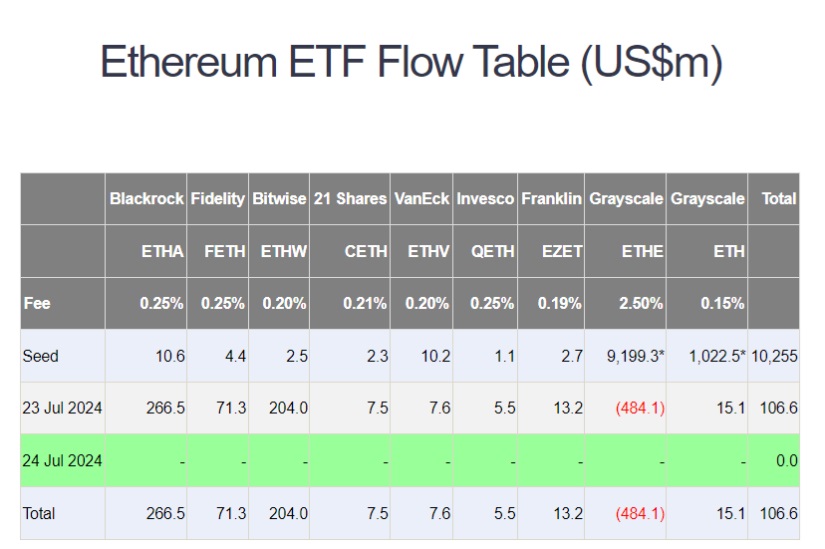

- BlackRock’s iShares ETH Trust led the inflows with $266.5 million, while Grayscale recorded outflows of $484.1 million.

- The total net assets in these ETFs were $10.24 billion, representing approximately 2.45% of Ethereum’s market capitalization.

On July 23, 2024, a historic day for the US financial market marked the launch of the first Ethereum exchange-traded funds (ETFs). These financial instruments, which allow investors to access the performance of the digital asset without having to own it directly, received approval from the Securities and Exchange Commission (SEC) following final regulatory filings, allowing nine Ethereum ETFs to begin trading.

The debut of these ETFs was impressive, accumulating a net inflow of $106.7 million on their first day of operations. In terms of trading volume, the funds achieved a combined total of over $1.1 billion. Their initial success is a testament to the interest and demand from investors for investment products linked to the crypto market, especially Ethereum.

Among the different ETFs launched, BlackRock’s iShares Ethereum Trust led the inflows with $266.5 million. Its outstanding performance placed BlackRock at the forefront of the ETH ETF market on its first day. Other ETFs also recorded significant inflows, with Bitwise obtaining $204 million for its ETHW product and Fidelity recording $71.3 million for its FETH ETF.

BlackRock Leads the Ethereum ETF Market

However, not all news was positive for ETH ETF issuers. The Grayscale Ethereum Trust (ETHE) experienced significant capital outflows, with a total of $484.1 million in negative flows. However, the same company saw a small respite with its ETH Mini Trust, which attracted $15.1 million in inflows. Other ETFs, although not as prominent, also contributed to the total inflows, including Franklin Templeton with $13.2 million, VanEck with $7.6 million, 21Shares with $7.5 million, and Invesco Galaxy with $5.5 million.

In terms of trading volume, excluding the volume of over $469 million from BlackRock’s ETF, the other eight ETFs combined achieved around $642 million. This distribution indicates a solid and diversified interest in the different products available on the market.

James Seyffart, a Bloomberg ETF analyst, described the first day of the ETH ETFs as “very solid,” highlighting the overall success of the launch. According to data from SoSoValue, the total net assets amounted to $10.24 billion as of July 23, representing approximately 2.45% of Ethereum’s market capitalization, which stood at $413 billion at that time.

The anticipated launch of the Ethereum ETFs has been a resounding success. Now we must wait to see how their impact will be reflected in Ethereum and the broader crypto market in general.