TL;DR

- Jeffrey Wilcke, one of Ethereum’s co-founders, transferred 105,736 ETH (approximately $262 million) to Kraken, raising fears of a possible massive sell-off.

- Despite the move, Ethereum rose 2.24%, and the amount of ETH held on exchanges fell to its lowest level in a decade (4.9%).

- Simultaneous fund withdrawals by new wallets suggest a redistribution rather than a sell-off.

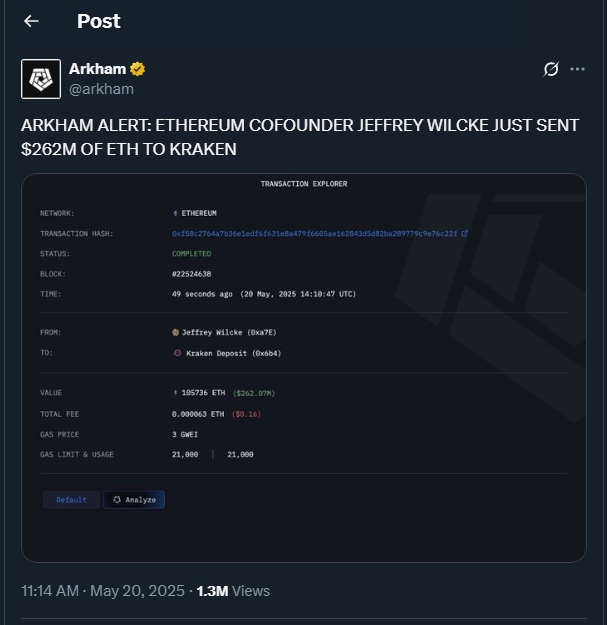

In an unexpected move, Jeffrey Wilcke, one of Ethereum’s co-founders, transferred over 105,000 ETH — valued at around $262 million — to the Kraken exchange. The transaction, spotted on May 19, 2025, drew attention not only for the massive amount but also because it came from a wallet that had remained inactive for months. Naturally, many interpreted the action as a potential sell signal, especially considering Wilcke had carried out a similar transaction in November 2024, right before ETH underwent a price correction. This pattern raises doubts about whether he might once again be anticipating a market downturn, as happened previously.

Asset Redistribution or Strategic Sell-Off?

Unlike previous instances, this time the transaction didn’t lead to a significant drop in ETH’s price. In fact, the ETH token has shown resilience and is currently trading around $2,607, marking a slight increase of 2.24%. Shortly after the transfer, eight newly created wallets withdrew nearly the same amount of ETH from Kraken, prompting several analysts to believe that Wilcke may have simply redistributed his holdings. It’s worth noting that transactions of this scale, even if not directly linked to selling, still exert pressure on the market and increase short-term speculation among traders and institutional investors.

Furthermore, Wilcke has made no official statements regarding the transfer, although he did share the news of the transaction on social media, adding to the mystery. However, the fact that there was no direct sale or notable negative impact on the market strengthens the theory that this could have been an internal or custodial operation.

Exchange Supply Drops: Good News for ETH

Another key data point is that ETH supply on exchanges has fallen to just 4.9%, the lowest level in the past ten years. This usually signals that investors are choosing to store their assets in cold wallets, which is often interpreted as a bullish long-term indicator.

Rather than panic, many Ethereum advocates see this type of movement as part of the natural evolution of the ecosystem. The transparency provided by blockchain technology allows these events to be tracked in real-time, reinforcing trust in a system that continues to cement itself as the backbone of decentralized finance and future applications.