Ethereum (ETH) prices are pinned down when writing on May 11.

The inability of bulls to support prices, and rewinding recent losses is a concern for bulls, dumping down optimism.

As it is, traders can look at how prices react today, aware that any sharp dump below $1,800 may see ETH drop to $1,700 or worse in the days and week ahead. For now, ETH price action favors sellers in the short term.

Nonetheless, in the longer time frame, buyers have the upper hand.

Any spike above $2,000 may lift ETH towards April 2023 highs in a buy trend continuation formation.

More ETH Staked, PEPE Mania Drives Gas Fees

The influx of ETH to staking addresses can be interpreted as bullish for Ethereum in the medium to long term.

The more coins tied to the network, the more robust it becomes, meaning there is a guarantee of security against third parties.

There were earlier concerns that with Ethereum being fully proof-of-stake, more users would choose to liquidate their assets. However, this is turning out to be a bullish event for the platform.

Trackers show that more validators are willing to bolster the blockchain with more influx than outflow of coins to centralized exchanges.

Amid this development is the meme token craze led by pepe coin (PEPE).

Although the holder count is falling after PEPE’s listing on Binance, Gas fees are relatively higher.

This highlights the significance of the project and how users can FOMO on projects aiming for quick profits.

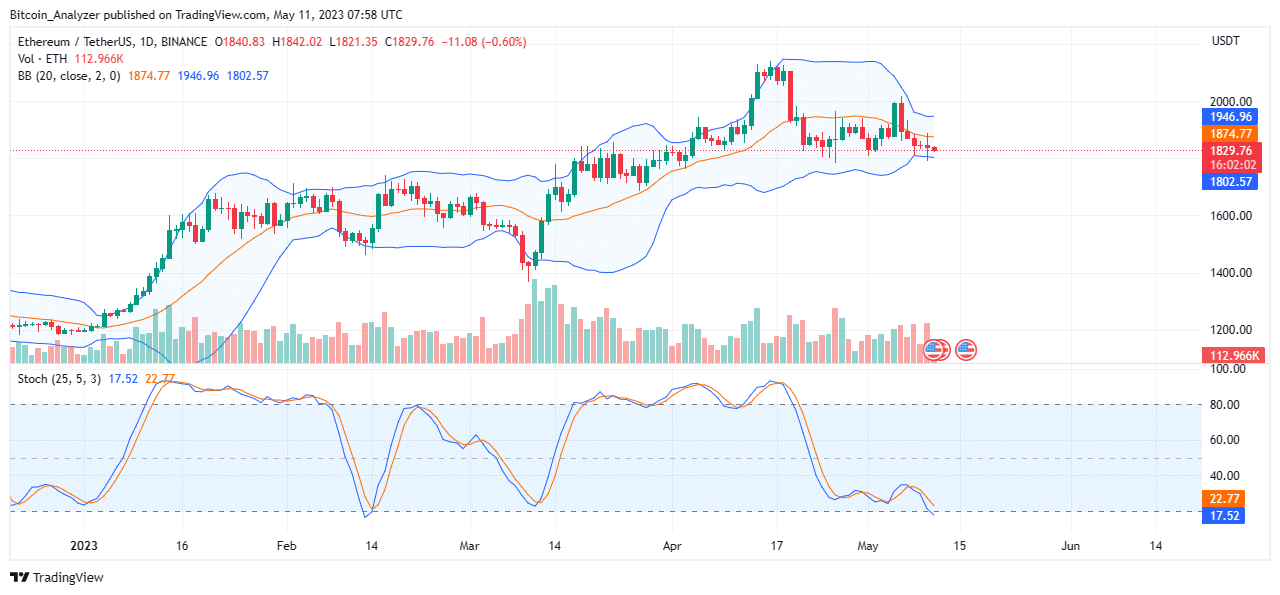

Ethereum (ETH) Price Analysis

ETH prices remain in a broad consolidation but tracking lower when writing. The coin is down 15% from April highs and likely to retest $1,800; the immediate support level. If sellers press on, this critical support line will be broken.

Traders can look for shorting opportunities provided prices are below $2,000, trading inside the bear range from May 6 to 8. Notice that prices are also inside the bearish Doji bar of April 26, with prices still anchored by the sellers forming the “pole” of the bear flag from April 19.

In this formation, conservative, risk-on traders can wait for a comprehensive close below $1,800, preferably with rising volumes, to sell on attempts higher, targeting $1,700. This target line flashes with the 61.8% Fibonacci retracement level of the March to April 2023 trade range.

Any upswing above $2,000 nullifies this bearish preview.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Ethereum News.