TL;DR

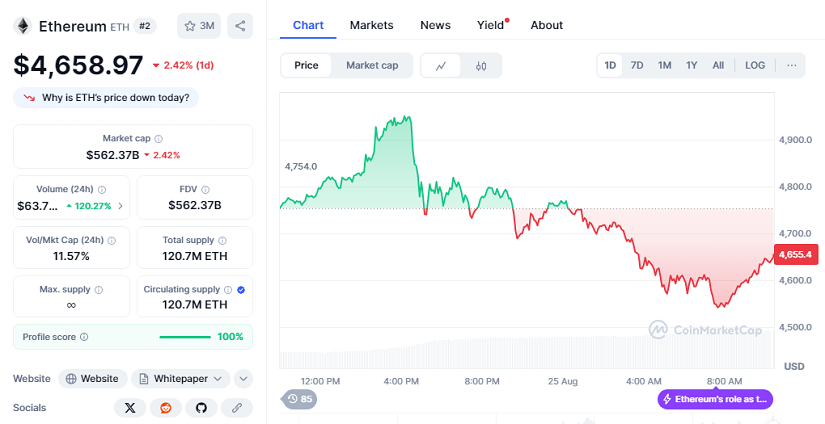

- Ethereum reached a fresh all-time high near $4,953 after more than $20 billion in inflows boosted its market capitalization to $562.37 billion.

- Despite a 2.42% pullback in the last 24 hours, the asset continues to attract institutional demand while dominating the derivatives market.

- Analysts highlight whale accumulation, upcoming network upgrades, and favorable macroeconomic conditions as key drivers that could propel ETH toward the $10,000 threshold in the coming cycle.

Ethereum has reclaimed momentum and surged beyond its previous peak, consolidating its role as the second most valuable cryptocurrency. At the time of writing, ETH trades at $4,658.97, slightly lower in the past 24 hours yet holding strength after hitting $4,953 earlier this week. With its market capitalization standing at $562.37 billion, Ethereum is reinforcing its dominance across multiple market segments and capturing fresh interest from investors searching for alternatives to Bitcoin.

Whale activity has been one of the main catalysts behind the rally. On August 24, wallets holding between 1,000 and 10,000 ETH accumulated roughly $2.5 billion in tokens, marking the largest single-day purchase since 2018. Such activity is usually interpreted as strong long-term conviction. Alongside this, Glassnode data confirmed that Ethereum’s perpetual futures trading volume reached 67% of the entire crypto derivatives market last week, signaling a shift in trader focus toward ETH and showcasing rising appetite for leveraged exposure.

Institutional Demand And Development Momentum

Institutional inflows have also gained traction. Ethereum now represents 43.3% of overall open interest, moving closer to Bitcoin’s 56.7% share. This narrowing gap highlights how liquidity is being redistributed in favor of ETH, a trend that analysts believe will continue if current flows sustain.

On the technical front, the upcoming Fusaka hard fork in November is expected to integrate PeerDAS for scalable data availability and triple gas limits, reducing costs for Layer 2 activity and potentially fueling new decentralized applications. Developers emphasize that the upgrade could mirror the success of May’s Pectra update, which triggered a noticeable spike in network usage.

Price Outlook And Macro Environment

From a market structure perspective, analysts suggest Ethereum has broken free from a prolonged consolidation phase, opening the door to higher levels. Technical strategist Ted Pillows sees the $5,000 resistance as a near-term checkpoint before a continuation toward $10,000. Macroeconomic factors could further accelerate this trajectory.

A potential shift in Federal Reserve policy toward rate cuts might enhance liquidity, with experts such as Tom Lee and Bernstein forecasting Ethereum to outperform Bitcoin in the next expansion cycle. If this scenario materializes, ETH could cement its role as the leading asset for decentralized finance and Web3 infrastructure, expanding its influence far beyond speculative trading.