Ethereum is at new H2 2021 highs, trending above $4.2k. ETH is up 11 percent versus the USD at present levels week-to-date, and buyers are bullish about what lies ahead.

Technically, the upswing is favored.

Fundamentals lean for the second most valuable project reading from its roadmap.

For example, over $2 billion of ETH have thus far been destroyed with EIP-1559.

The Fed printed over $1 trillion dollars in 10 months#Ethereum has burned $2.6 billion dollars since August 5th

This is why $ETH is Ultra Sound Money 🦇🔊

— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) October 25, 2021

Although Gas fees are stubbornly high, ETH is on the path to becoming ultrasound money once its emission is lower than activity-generated burns.

Analysts predict a situation once Proof-of-Stake activates where inflation will be lower than the rate of coin burns. This by itself would create a state of coins scarcity, precisely what ETH holders anticipate—a primer for more gains in the years to come.

In the same vein, the Altair Upgrade will be added to the Beacon Chain. This enhancement aims to introduce improvements such as more severe penalties for rogue validators, support for light clients, and more.

Is $50k by September 2022 for ETH Tenable?

Already, Deribit Exchange traders expect ETH to swing higher in the months ahead.

For instance, the derivatives exchange has Call options with a strike price of $50k for ETH, expiring on September 22. At this valuation, there are similar Call Options for BTC with a strike price of $400k.

Big Strike Alert: 50k Sep22 in #ETH and 400k Sep22 in #BTC strikes introduced!

Are buying calls on those strikes only for dreamers? 🚀

— Deribit (@DeribitExchange) October 25, 2021

If this indeed is the sentiment amongst traders, ETH might be undervalued and an opportunity for value traders. They can buy and HODL without leverage and still realize huge ROI.

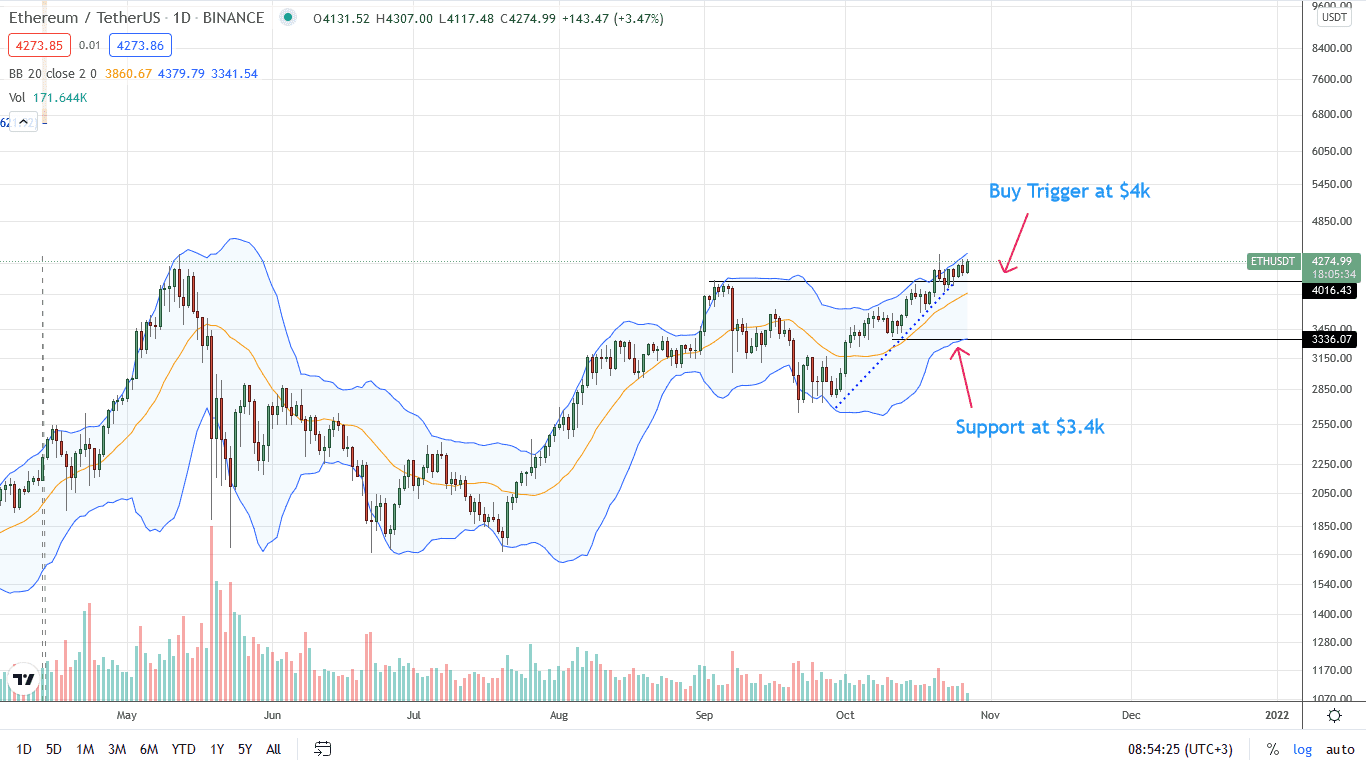

Ethereum Price Analysis

ETH prices are solid from the daily chart, adding 11 percent week-to-date ahead of the critical update.

In a bullish breakout pattern above September 2021 highs, every low may present a loading opportunity for aggressive traders.

As per the candlestick arrangement of the ETH/USDT on the daily chart, the immediate target is at all-time highs at around $4.3k.

However, a close above this level may present better entries in a bullish continuation for risk-on traders.

Based on the Fibonacci extension level of the H1 2021 trade range, ETH prices might surge to $6.6k—the 1.618 extension level once buyers clear $4.3k.

Leaning on caution, an unexpected dump below $3.8k nullifies the uptrend as ETH prices pull back after months of higher highs.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News