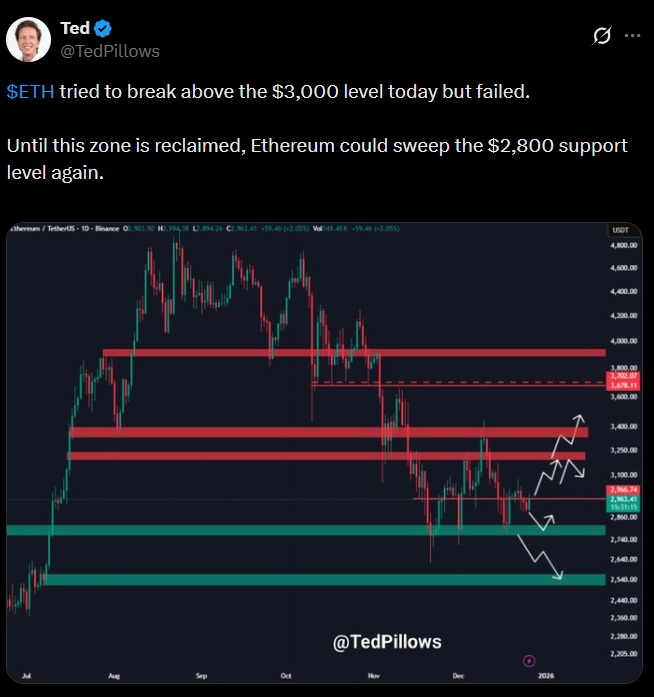

Ethereum pushed the $3,000 zone again but failed to hold the breakout and continues to trade slightly below that level. Analysts agree that this resistance defines the short-term bias: a decisive break would open the door to a move toward the all-time high near $4,954, while another rejection could send the market to retest the $2,800 support.

The session was marked by higher volatility, partly driven by the expiration of roughly $3.8 billion in Ethereum spot options, with the max pain level sitting exactly at $3,000. After dipping to lows around $2,900, the price bounced, though without confirming a structural shift.

At the same time, on-chain data points to steady accumulation by large investors. One whale bought around $16 million worth of Ethereum on December 25 and has accumulated roughly $130.7 million over the past three weeks. Other large holders acquired about 220,000 ETH in the last week, equivalent to nearly $660 million.

From a technical perspective, some analysts identify a hidden bullish divergence similar to the setup seen in 2023. If a breakout above the previous all-time high is confirmed, the long-term scenario projects a potential target in the $8,500 area.

Source: https://x.com/TedPillows/status/2004470659901231608

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions