The Ethereum price is resilient, expanding and cementing its place above $2k ahead of what would perhaps be a historic upgrade in the network’s short history.

As of writing, Ethereum prices are up double digits in the last trading week, though stable on the previous day with decent trading volumes fortifying the uptrend.

Ethereum Will Occupy Its Rightful Place

Traders are generally a bullish lot in light of how candlestick arrangement is and the coin’s fundamentals.

Besides, there is hope that DeFi will continue expanding, forming a big part of Ethereum in the days ahead.

Presently, competing platforms are hawking the “gas” narrative as their distinguishing value proposition. However, this will be excised in a precise surgery in the next few weeks once intensive dApps, especially in DeFi, begin integrating Layer-2 options.

Already, Gas fees are at a manageable level. This is after Ethereum developers voted to increase block limit size to around 15 million—essentially allowing more transactions to be packed in every block—and drumming up support for Layer-2—a move that’s currently paying dividends.

Uniswap Optimism and Token Delisting

Uniswap has already integrated Optimism—but in Alpha—with plans of fully rolling out the feature, relieving users of the relatively high transaction fees they always have to pay.

Meanwhile, in an unexpected move calling into question the decentralization level of the DEX, it delisted several tokens they deemed as securities.

As of today, we have started restricting access to a small number of tokens at https://t.co/liqYXtQoM2

These changes pertain to the interface at https://t.co/liqYXtQoM2 — the Protocol remains entirely autonomous, immutable, and permissionless.

Read more:https://t.co/60swtFXbsE

— Uniswap Labs 🦄 (@Uniswap) July 23, 2021

These were from projects which had tokenized stocks and precious metals. Uniswap said the delisting was done as they monitor the evolving regulatory environment.

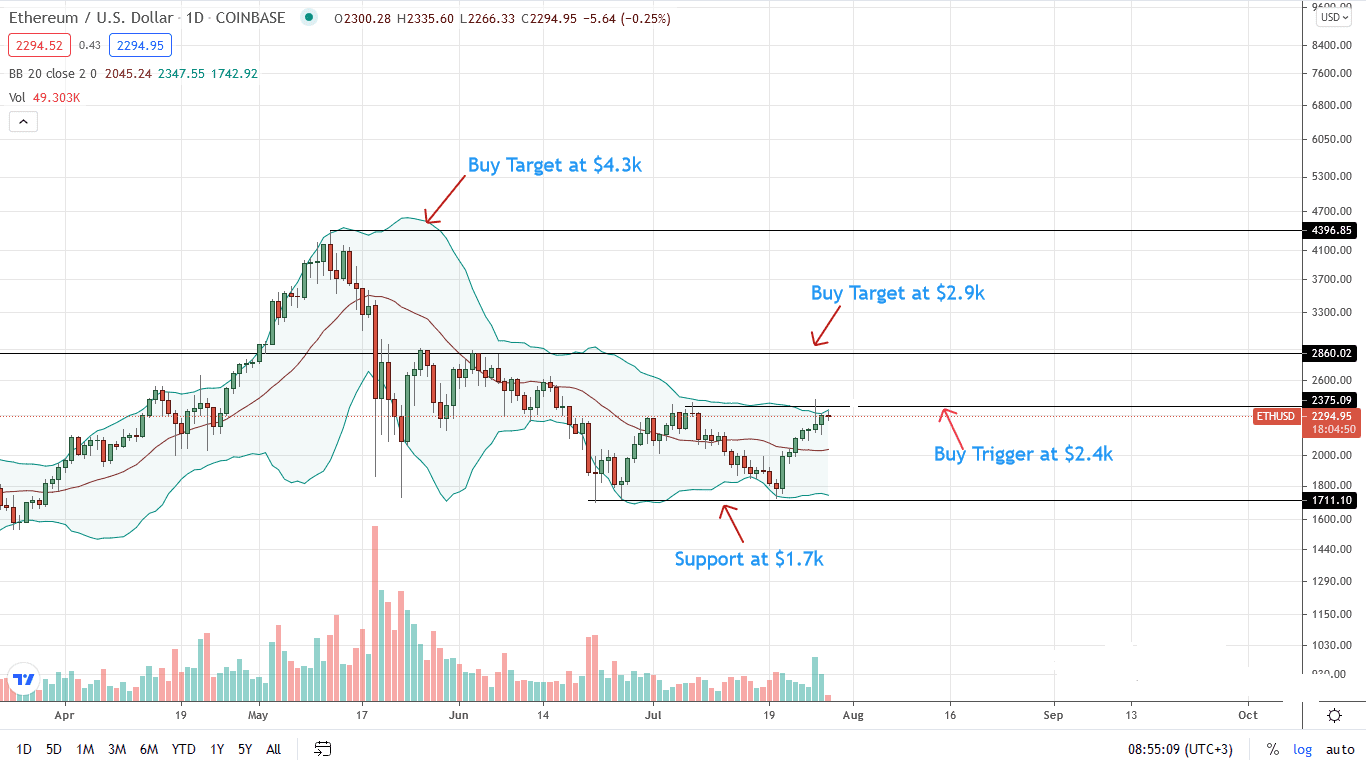

Ethereum Price Analysis

At the time of writing, ETH is up 23 percent on the last week of trading, posting sharp gains against the greenback.

Backed with rising trading volumes and improving trader sentiment, the atmosphere favors buyers. From the daily chart, ETH/USD prices are firm above $2k and stretching away from the minor support line at around $1.8k

Technically, every low provides a loading opportunity for traders targeting $2.9k in the medium term. However, the uptrend will be accelerated once a conclusive–preferably high volume–wide-ranging bull bar closes above July 2021 highs at around $2.4k.

The breakout will likely attract more buyers, fueling demand, a launchpad for another move higher in a buy trend continuation pattern.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Ethereum News