TL;DR

- Deribit will integrate Ethena’s stablecoin USDe into its cross-collateral system starting in January 2025, allowing rewards for its use in derivative trades.

- The adoption of USDe opens new opportunities for structured products within the derivatives ecosystem.

- The ENA token saw a 9% increase in 24 hours and a 62% increase in the last 30 days, reflecting market optimism.

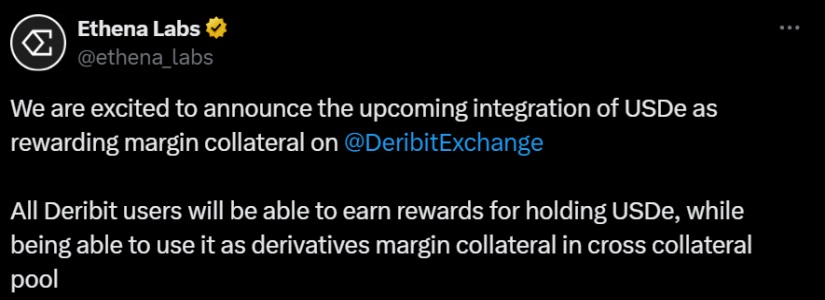

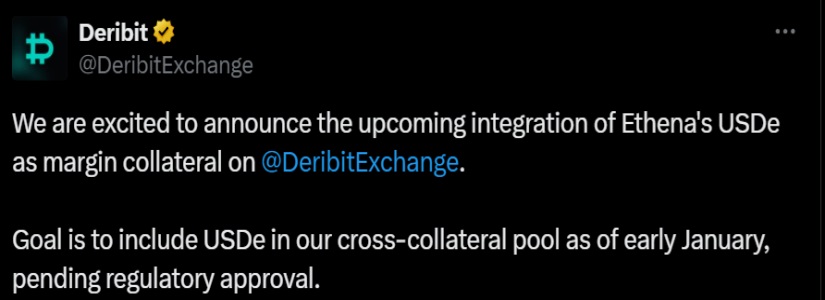

Ethena, the decentralized protocol behind the synthetic stablecoin USDe, has announced a collaboration with Deribit, one of the largest cryptocurrency derivatives exchanges in the world.

Starting in January 2025, and pending regulatory approval, Deribit will integrate USDe into its cross-collateral system. This will allow platform users to use USDe as collateral for derivative trades and earn rewards for holding the synthetic stablecoin.

New Products and More Opportunities

The integration of USDe paves the way for new structured products within the derivatives ecosystem, especially in an environment like Deribit, where the options market represents more than 85% of the global share. The collaboration will enable traders to access more sophisticated financial opportunities and investors to diversify their portfolios by using USDe instead of traditional stablecoins.

Ethena (ENA) Receives Market Support

The news had an immediate impact on the market. The governance token ENA, associated with the Ethena ecosystem, saw a rise of about 9% in the last 24 hours, reaching $0.6 and consolidating a 62% growth in the last 30 days. The market has shown optimism about the adoption of USDe on such a relevant platform as Deribit, strengthening Ethena’s position against its competitors.

USDe, unlike other stablecoins backed by traditional assets like physical dollars, is supported by delta-hedged derivative positions in futures and perpetual markets, making it fully decentralized and more resistant to risks associated with centralized stablecoins. Its innovative design has been a key factor in its integration on platforms like Bitget and Gate, which have also started using USDe as collateral.

On the other hand, Ethena has announced that it continues expanding its ecosystem, with the upcoming launch of a new stablecoin, UStb, which will be developed in collaboration with BlackRock and Securitize