TL;DR

- Ethena Labs has decided to drop its bid to issue USDH on Hyperliquid after facing criticism from validators and the community.

- Guy Young explained that Ethena is not a native Hyperliquid team and has broader goals, so it chose to step aside.

- The final vote will take place on Sunday to determine the USDH issuer, a market that could affect $5 billion in USDC and generate $200 million in annual revenue for Circle.

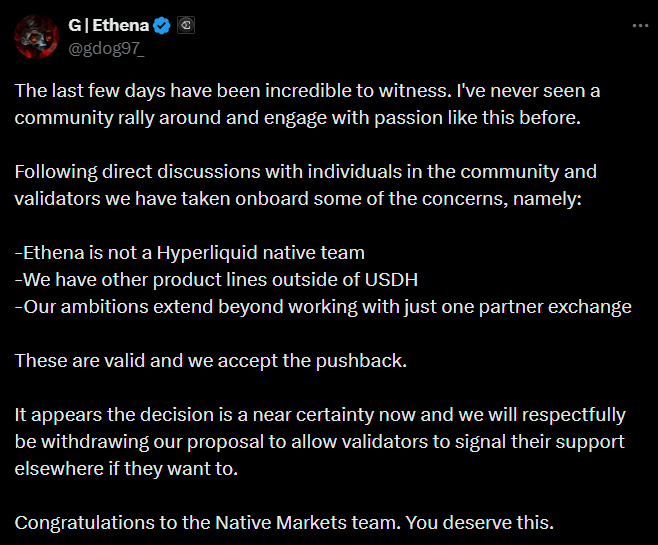

Ethena Labs has withdrawn from the race to issue Hyperliquid’s USDH stablecoin following concerns raised by validators and community members about its role within the ecosystem.

Reasons Behind Ethena’s Decision

Project founder Guy Young explained that the decision was based on three main factors: Ethena is not part of Hyperliquid’s native team, it develops products beyond the scope of USDH, and it pursues goals that go beyond working with a single exchange. Young noted that the team preferred to step aside rather than directly confront the arguments put forward by the community.

Ethena’s withdrawal clears the way for Native Markets, which is now seen as the frontrunner to issue USDH. Predictions on Polymarket give Native Markets a 92% chance of success, while Paxos sits in second place with about 7%. Young publicly congratulated the competitor and emphasized Hyperliquid as an environment where emerging teams can earn community trust regardless of size or resources.

What’s Next?

Even though it is stepping away from the USDH race, Ethena will continue to focus on other products within Hyperliquid. Its roadmap includes synthetic dollars (hUSDe), savings solutions, USDe-backed cards, and hedging flows designed for the platform’s markets. Ethena also plans to explore new markets under HIP-3, including reward-bearing collateral, modular prime broking, and perpetual equity swaps, with the goal of driving innovation and competing on product strength.

The USDH selection process has sparked debate over fairness. Some argue that Native Markets had an advantage by submitting its proposal almost immediately after the Request for Proposals was announced, while other teams finalized their submissions later. Critics have also questioned whether Native Markets has the ability to scale USDH into a large stablecoin. Others, however, believe the outcome may simply reflect a better fit for the project, even as Paxos remains recognized as an experienced issuer of fiat-backed stablecoins.

The vote to determine the USDH issuer will take place on-chain. Validator voting power is tied to the amount of HYPE tokens staked. Proposals must secure two-thirds of the total stake to pass, and delegators can redelegate their tokens to validators aligned with their preferences.

The final vote is scheduled for Sunday between 10:00 and 11:00 UTC. USDH is expected to influence about $5 billion worth of USDC on Hyperliquid, which could represent roughly $200 million in annual revenue for Circle