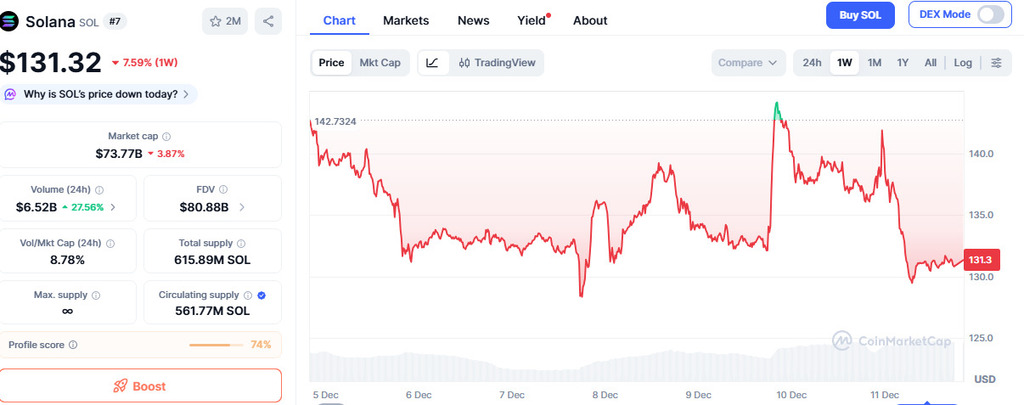

Crypto markets have been relatively range-bound in recent sessions. Ethereum (ETH) has traded near $3,300 while Solana (SOL) has hovered around $137, with limited directional follow-through compared with earlier in the year.

Against that backdrop, Digitap ($TAP) is an early-stage project that describes itself as an “omni-bank” ecosystem focused on crypto payments and consumer-facing financial tools. The project is currently running a token sale.

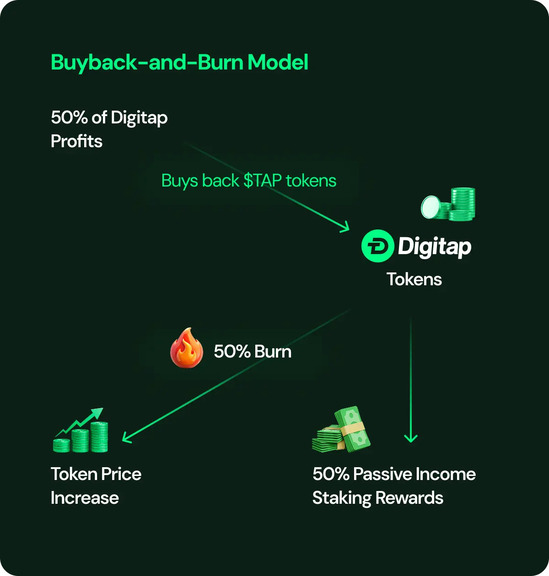

Digitap’s materials also describe a buyback-and-burn mechanism intended to reduce circulating supply over time. As with similar designs across the sector, how such a mechanism affects a token’s market price depends on multiple factors, including actual usage, market liquidity, and broader conditions.

The sections below summarize recent price ranges for ETH and SOL and outline what Digitap says it plans to build, without implying any outcome or recommendation.

As ETH and SOL Consolidate, Attention Shifts to Smaller Tokens

Ethereum and Solana rank among the largest ecosystems in crypto. However, their price action over the past several weeks has remained largely sideways.

ETH has been locked between $3,000 and $3,400, with traders watching for clearer catalysts. Market participants often cite factors such as macro conditions, network activity, and regulatory developments as potential drivers, though none guarantees a specific move.

SOL has also been choppy after earlier gains this year, and it has settled near 137 without a sustained trend. While Solana is known for throughput and an active developer ecosystem, token prices can still be driven by broader risk sentiment and liquidity conditions.

When large-cap assets consolidate, some traders and investors look to smaller, higher-risk tokens for potential upside. Digitap is one such project, and it has highlighted buybacks and burning as part of its planned token design.

Digitap’s Claimed Utility and Token Design

Projects that emphasize real-world use cases and token supply mechanics often receive attention during periods of uneven market performance. Digitap says it is developing a payments-focused “omni-bank” product suite and associated infrastructure.

According to the project, planned features include card-linked spending and crypto payment tools. Requirements such as identity verification (KYC) and availability can vary by jurisdiction and service provider, and users should review terms and applicable regulations before using any financial product.

Digitap also points to a buyback-and-burn approach as a core part of its tokenomics. These mechanisms can reduce supply, but they do not ensure long-term value preservation or price appreciation.

Any assessment of such designs typically depends on whether the underlying product gains sustainable usage and whether the buyback/burn process is implemented transparently and consistently.

How Buyback-and-Burn Models Are Typically Described

Buyback-and-burn systems are generally described as mechanisms that use a portion of project revenue or fees to repurchase tokens and remove them from circulation. Once burned, tokens are typically not returned to the market, which can affect circulating supply.

Digitap’s materials describe using ecosystem fees to buy $TAP on the open market and then burn those tokens. The frequency, amounts, and reporting standards for any such process are project-specific and may change over time.

Even where buybacks and burning occur, token prices can still be influenced by broader market volatility, adoption pace, competition, and the concentration of holders.

Market Context: Risk Considerations for Early-Stage Tokens

Early-stage tokens typically carry higher risks than established assets, including execution risk (whether products are delivered), liquidity risk (thin markets), and regulatory risk. As a result, comparisons with large-cap assets such as ETH and SOL are limited by differences in maturity, adoption, and market structure.

Digitap is positioning $TAP as a utility token linked to its planned ecosystem. Whether that positioning translates into durable demand is uncertain and depends on real-world usage and broader market conditions.

Funding and Token-Sale Details (Project-Reported)

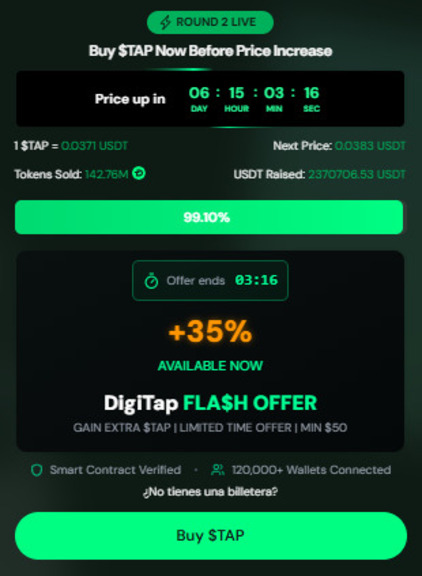

Digitap says it has raised more than $2.3 million in early funding.

The project reports a current token-sale price of $0.0371 and says more than 141 million $TAP tokens have been sold so far. Token-sale prices are set by the project and do not necessarily reflect secondary-market pricing or future value.

Digitap has also described time-bound marketing incentives tied to the token sale, including seasonal promotions and bonus distributions. Such incentives are promotional in nature and should not be treated as indicators of investment merit.

Project Links (For Reference)

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.