TL;DR

- Bitcoin’s price fell over 33% from its all-time high near $126,000.

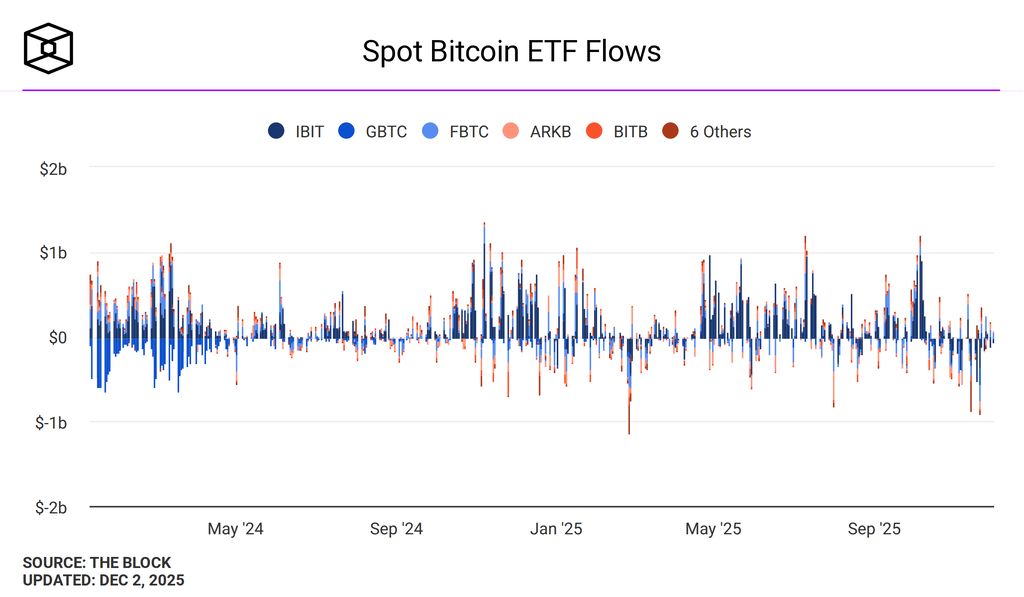

- Analysts debated whether massive ETF outflows were the primary cause of the drop.

- Vanguard reversed its policy and will now allow trading of crypto-linked funds.

The price of Bitcoin dropped over 33% from its record peak near $126,000, erasing weeks of gains and triggering widespread liquidation across the crypto sector. As of early December, Bitcoin trades between $84,000 and $86,500, with fear indicators flashing red. Many investors secured profits while institutional selling deepened the decline.

At the same time, US spot Bitcoin ETFs recorded some of their largest redemptions to date, raising debate over their influence on price.

Analysts at Citi Bank reignited controversy by claiming that ETF outflows directly contributed to Bitcoin’s decline. Their report calculated that each $1 billion withdrawn from US spot ETFs correlates with a 3.4% price drop in Bitcoin. The conclusion portrayed ETF flows as a primary driver of downward momentum in November.

Bloomberg’s Eric Balchunas, senior ETF analyst, strongly disagreed. In a post on X, he argued that the Citi model ignored year-to-date inflows of $22.5 billion into Bitcoin ETFs.

Starting tmrw vanguard will allow ETFs and MFs tracking bitcoin and select other cryptos to begin trading on their platform. They cite how the ETfs have been tested performed as designed through multiple periods of volatility. Story via @emily_graffeo pic.twitter.com/AKhMdR7pab

— Eric Balchunas (@EricBalchunas) December 1, 2025

Using Citi’s logic, he said, Bitcoin should have gained 77% this year—an inconsistency that exposes flaws in the correlation. Balchunas stressed that ETFs account for only around 3% of total selling pressure, and blaming them oversimplifies market behavior.

According to SoSoValue, US-listed Bitcoin ETFs saw $3.79 billion in withdrawals during November, surpassing the February record of $3.56 billion. BlackRock’s iShares Bitcoin Trust (IBIT) led redemptions with $2.47 billion, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $1.09 billion.

Combined, both funds represented over 90% of all redemptions, concentrating selling among large institutional vehicles. Citi strategist Alex Sonders explained that ETF creation and redemption mechanisms tie directly to Bitcoin’s spot price, as authorized participants must buy or sell Bitcoin to balance investor demand.

The selloff extended beyond ETFs

Open interest in Bitcoin derivatives dropped 35% from October peaks, according to CoinGlass. Traders who once relied on leverage liquidated positions entirely, fearing a repeat of the October 10 wipeout event. By the end of November, Bitcoin’s market structure showed clear risk aversion as margin exposure collapsed and liquidity pools thinned.

Recent ETF data pointed to a brief recovery in flows. Farside Investors reported $8.5 million in net inflows on Monday, marking the fourth consecutive day of positive movement. While IBIT logged $74 million in redemptions, FBTC attracted $67 million, and ARK Invest’s ARKB added $7.38 million, helping balance aggregate inflows. Despite the improvement, Bitcoin failed to sustain a rebound, slipping from $92,000 to $86,500 within two sessions.

Vanguard made a headline-grabbing policy reversal

The broker, with 50 million brokerage clients, now allows trading of crypto-focused ETFs and mutual funds—a sharp departure from its previous stance that labeled cryptocurrencies “too speculative.” Starting Tuesday, Vanguard clients can trade funds with exposure to Bitcoin, Ethereum, XRP, and Solana, marking a historic step toward mainstream crypto integration.

Andrew Kadjeski, head of brokerage and investments at Vanguard, stated that crypto ETFs have proven resilient, maintaining liquidity through volatile periods. He emphasized that such funds have functioned as designed, handling redemptions and new inflows even during price shocks.