TL;DR

- DYDX launches a zero-fee and staking discount strategy to incentivize on-chain traders and strengthen its position against competitors.

- Trading fees for BTC and SOL will be waived on specific days, and users will receive up to 50% discounts until the end of 2025.

- Despite TVL dropping to $310M and the token’s market value falling to $260M, DYDX aims to recover $0.55 and reignite user interest on the platform.

DYDX implemented a strategy to boost activity on its decentralized exchange (DEX) in response to growing competitors such as Hypeliquid and Aster. The initiative seeks to attract more on-chain traders, improve market dynamics on its platform, and reinforce its position in an increasingly competitive sector.

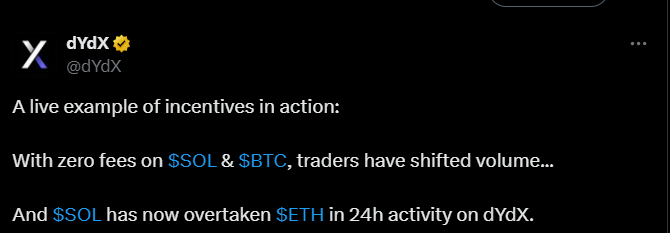

The plan involves temporarily eliminating trading fees for BTC and SOL on specific days, mainly during holiday periods. In addition, users will receive a 50% discount on positive trading fees until the end of 2025. The discount system is also linked to DYDX staking: the larger the amount staked, the higher the applicable reduction. These measures were implemented following the community-approved v9.4 update, designed to optimize the trading experience and platform adoption.

However, DYDX faces a challenging environment. Data from DeFi Llama show that its TVL (Total Value Locked) has steadily declined from a $1.9 billion all-time high in 2023 to below $310 million in 2025. Open positions fell under $150 million, and the market value of the native token dropped to $260 million, reflecting lower user interest and engagement within the ecosystem and platform.

DYDX Aims to Revitalize Its Ecosystem and Reverse the Downtrend

During token launches, the platform recorded spikes in value and open interest, demonstrating robust protocol usage. However, subsequent market downturns led to a stabilization at significantly lower levels. DYDX now targets $0.55 as its initial recovery goal, with subsequent targets at $0.8 and $1.21, and potential to reach between $1.87 and $2.73 if market appetite grows and platform activity remains strong.

The zero-fee initiative is combined with staking incentives and temporary discounts to revitalize the platform and attract new users. Despite current challenges, DYDX seeks to prove it can compete in a highly fragmented market and provide attractive conditions for on-chain traders