TL;DR

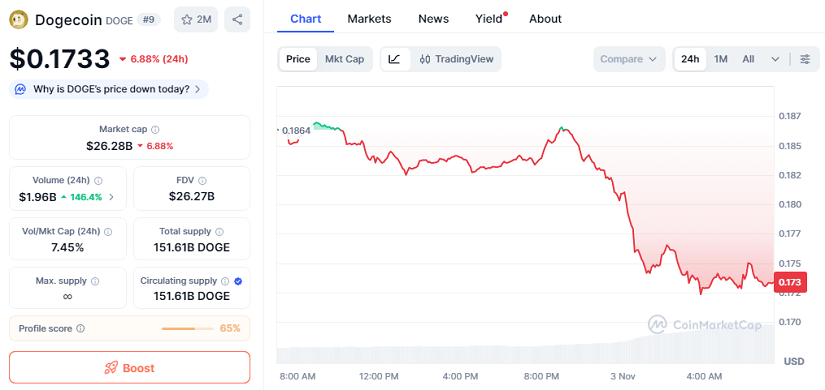

- Dogecoin slipped 6.88% in the past 24 hours to 0.1733 dollars as large holders reduced exposure.

- Trading volume jumped 146% to 1.96 billion dollars, showing strong activity despite the drop.

- Analysts in the United States still see potential for a rebound, supported by long-term technical patterns and an optimistic outlook for crypto assets ahead of 2026.

Dogecoin faced another volatile session in the United States on Monday, becoming the weakest performer among the top ten digital assets by market value. The coin’s market capitalization of 26.28 billion dollars reflects that despite the correction, interest in the asset remains significant. Many crypto supporters argue that growing regulatory clarity expected in 2026, together with continued institutional interest, could strengthen demand for leading memecoins.

The sell-off comes as Bitcoin corrected below key resistance levels and sentiment cooled across the broader crypto market. As is often the case, memecoins absorbed sharper losses as traders reduced short-term leverage. On-chain data also indicates that addresses holding over 100 million DOGE have shown limited accumulation this month, signaling caution among larger players for now. Futures open interest for DOGE slipped just over 2%, hinting that part of the decline may be tied to reduced margin exposure rather than a full shift in fundamentals.

Market Reaction And Key Support Levels

Despite its setback, Dogecoin continues to hold above a multi-month support zone monitored closely by analysts. A retest toward 0.15 dollars remains possible if selling extends, but technical specialists point out that the asset has repeatedly recovered from similar dips in this cycle. The surge in trading volume suggests that dips are being actively bought and traded, a dynamic often seen before trend reversals.

Smaller U.S.-based retail investors appear to be taking advantage of discounted prices, with several exchanges reporting increased DOGE inflows from new accounts over the weekend. This may provide the first signs of renewed accumulation if the price stabilizes in the short term.

Technical Setup Points To Possible Upswing

Chart analysts note that Dogecoin’s Relative Strength Index on higher timeframes has returned to zones historically associated with strong rebounds. Since mid-2023, the asset has respected an ascending support structure that has preceded multi-week rallies. If this formation continues to hold, a recovery toward previous highs near 0.50 dollars could unfold gradually.

For now, the crypto market awaits fresh catalysts, but Dogecoin’s loyal investor base and rising participation during pullbacks continue to fuel expectations that the coin may turn its current correction into another upward phase.