As the crypto market shows signs of a bearish trend heading further into 2026, investor behavior is shifting toward protocols offering practical utility. With risk appetite constrained and liquidity increasingly selective, assets that can demonstrate functional usage are being closely monitored compared to those reliant on long-term projections.

This change in capital flow is visible when analyzing the performance of Cardano (ADA) alongside emerging projects like Digitap ($TAP). Cardano, a research-driven alternative to Ethereum, has recently maintained a price level of approximately $0.29. Despite its established community, the network continues to work toward translating its technical framework into increased economic activity.

In contrast, Digitap, an omnibanking protocol currently in its presale phase, is gaining attention for its focus on converting digital assets into usable spending power. As Q1 progresses, this divergence is influencing decisions across both retail and early institutional segments.

Cardano (ADA) Technical Update: A Market Caught in Stagnation

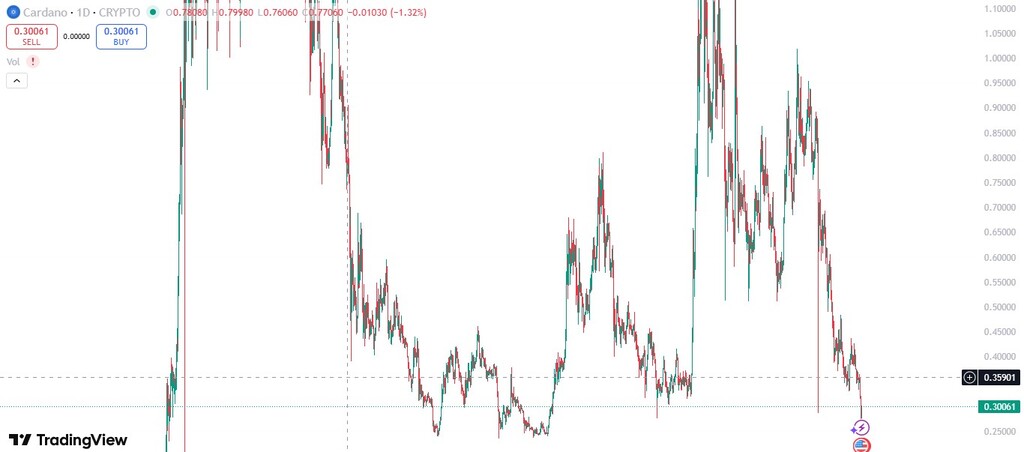

From a technical perspective, ADA continues to face headwinds. The token has remained near the $0.29 level for an extended period, reflecting cautious momentum. Market data shows ADA trading below both its 50-day and 200-day moving averages, reinforcing a broader trend observed since late 2024.

Analysts note that ADA is forming a descending triangle pattern, which often signals potential for further consolidation. The $0.35 level, previously a reliable support zone, has now transitioned into a resistance area. Repeated attempts to reclaim this level have yet to succeed, suggesting that market sellers maintain a significant presence.

ADA price chart. Source: Tradingview

Volume metrics further underscore the situation. Despite consistent community engagement, institutional participation appears muted. Order book depth on major exchanges indicates thinning bid-side liquidity, suggesting that short-term rallies may face immediate selling pressure. Without a significant catalyst to drive transaction activity, ADA’s price action continues to reflect a phase of consolidation.

Against this backdrop, investor attention is increasingly shifting toward platforms with perceived growth potential. Digitap, often highlighted among crypto presales with functional utility, is positioning itself for both new and experienced market participants.

Digitap ($TAP): Payments Infrastructure Built for Defensive Markets

Digitap’s growth in interest can be attributed to its focus on payment utility rather than speculative throughput. In cautious market conditions, users often move capital into stablecoins such as USDT and USDC to preserve value. Digitap provides the infrastructure designed to keep those assets active.

Through its non-custodial wallet and Visa-linked payment system, Digitap seeks to enable users to spend stablecoins on everyday expenses. This includes services like groceries, rent, and travel, aiming to reduce the need for routing funds through centralized exchanges.

While ADA continues its roadmap of protocol upgrades, Digitap focuses on immediate financial activity. This distinction is becoming relevant as transaction-based platforms aim for resilience regardless of broader market sentiment.

Token Economics: Comparing Supply Models in a Low-Growth Cycle

Another factor in the comparison between ADA and $TAP is token structure. Cardano utilizes an inflationary staking model, where new ADA is issued to reward validators. While essential for network security, this model introduces ongoing dilution which can impact price performance during periods of lower demand.

Digitap adopts a different approach. Its model incorporates a token mechanism where 50% of platform profits are intended to buy back $TAP from the market to reward stakers. This structure ties token availability directly to platform usage.

In a market environment where growth can be limited, these mechanics offer a different strategic advantage. As transaction volume increases, the circulating supply is designed to adjust, potentially supporting price stability.

Capital Rotation: Market Cap and Potential Upside

At $0.29, Cardano requires substantial capital inflow to generate significant upward movement. A 2x move would demand billions of dollars in new investment, a complex proposition in a risk-off environment.

Digitap, currently in its presale phase at a price of $0.0454, operates as a smaller-cap asset. With its focus on adoption and revenue pathways, it may show higher sensitivity to incremental capital inflows. This dynamic has made $TAP a point of interest for those seeking emerging presale opportunities.

The combination of its current valuation and functional utility has positioned Digitap as a candidate for capital rotation away from larger, more stagnant assets.

Market Outlook: Utility as the Defining Metric

The current market phase reinforces a key principle: utility sustains relevance when speculation fades. Governance rights and research narratives are increasingly being paired with the need for protocols that integrate into everyday financial behavior.

Digitap’s focus on payments aligns with this shift. Rather than waiting for future adoption, the platform aims to monetize existing demand for stablecoin usability. This has allowed it to gain traction as a long-term project of interest, even as broader market conditions remain uncertain.

For investors reassessing portfolio allocation in Q1, utility-driven protocols with real-world applications are gaining favor. In this context, Digitap is emerging as a closely watched opportunity as the market navigates its next phase.

Discover how Digitap is unifying cash and crypto by checking out their project here:

-

Presale: https://presale.digitap.app

-

Website: https://digitap.app

-

Social: https://linktr.ee/digitap.app

-

Giveaway Campaign: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.