Investment products in digital assets maintain their upward trend during week 161, marking their eleventh consecutive week of inflows, although with a significant decrease compared to previous weeks. In total, $43 million in inflows were accumulated. This phenomenon was influenced by a notable increase in short position inflows, generated by the recent price appreciation and perceptions of downside risks.

Breaking down the inflows regionally, Europe stood out in the first place with $43 million in inflows, while the United States recorded $14 million, with the peculiarity that half of this amount corresponded to inflows in short positions. On the other hand, Hong Kong and Brazil experienced fund outflows, totaling $8 million and $4.6 million in outflows, respectively.

The blockchain equities market went through significant days by reaching its highest weekly inflows on record, totaling around $126 million. This indicator reflects a growing interest and confidence in companies linked to blockchain technology.

Bitcoin Continues to Lead the Digital Asset Table

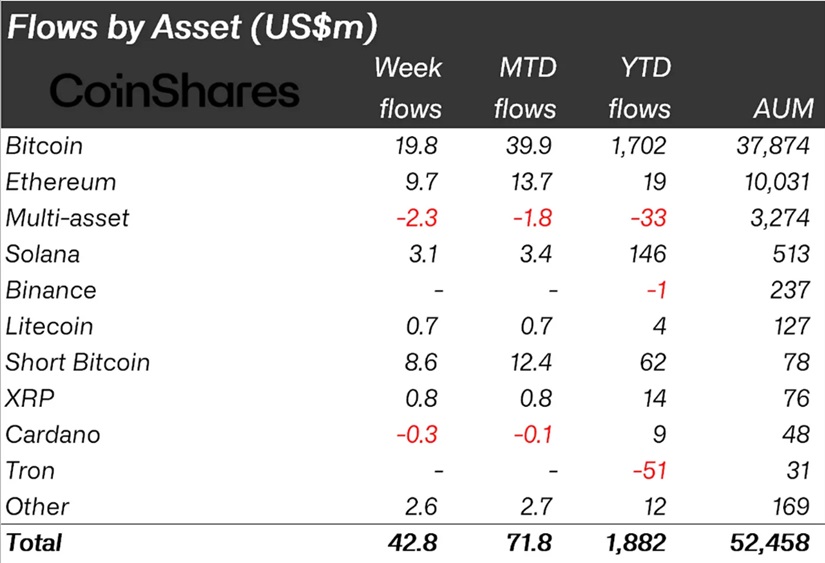

Bitcoin, as usual, remained the primary focus of investors, attracting $20 million in inflows during the week. This brought the year-to-date inflows for Bitcoin to a figure around $1.7 billion. However, inflows in short positions for Bitcoin were also observed, totaling $8.6 million, indicating that some investors believe that the recent price increases may not be sustainable.

A notable turnaround occurs with Ethereum, which experienced its sixth consecutive week of inflows, totaling $10 million. Just seven weeks ago, Ethereum had recorded year-to-date outflows of $125 million. Recently, there has been an impressive recovery and a consequent growth in its appeal to investors.

In the altcoin space, Solana and Avalanche continued to be favorites, attracting inflows of $3 million and $2 million, respectively. The figures highlight the development of altcoins and the persistent demand and confidence in cryptocurrencies beyond Bitcoin and Ethereum.

Despite the marked decrease in total inflows this week, the ongoing trend of positive inflows for eleven consecutive weeks suggests persistent confidence in digital assets and the investment market.