TL;DR

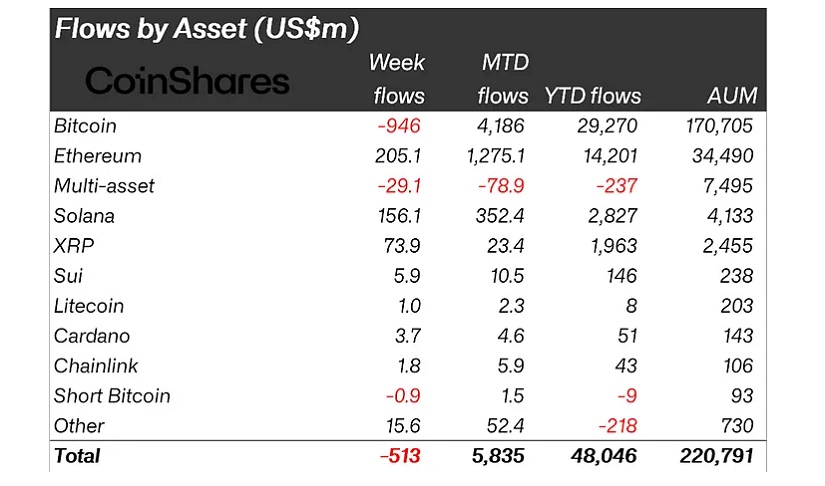

- Capital outflows from digital asset funds reached $513 million, with the United States driving most of the withdrawals.

- Despite this, Ethereum, Solana, and XRP recorded significant inflows, signaling selective confidence from institutional investors.

- Other regions such as Germany, Canada, and Switzerland bought the dip, showing that long-term strategic positioning remains strong outside of the U.S. market.

While net outflows were prominent, the broader landscape reveals that parts of the market continue to accumulate rather than retreat. The $513 million withdrawn globally came mostly from large U.S. vehicles, including products managed by iShares, Grayscale, ARK 21Shares, Fidelity Wise Origin, and Bitwise. These firms dominate assets under management (AUM), so their redemptions have a strong effect on weekly totals. However, some smaller issuers —including ProShares and CoinShares Digital Securities— saw modest inflows that helped soften the pullback. This dispersion suggests capital rotation rather than abandonment of the sector.

Even with Bitcoin facing withdrawals near $946 million, the asset still maintains substantial year-to-date inflows across global markets. Longer-range positioning remains relevant, especially as expectations around the next halving cycle and regulatory developments stay on the radar of institutional desks. Bitcoin’s setback contrasts with several altcoins, which attracted net inflows, indicating selective risk appetite rather than a wholesale retreat from crypto exposure.

Regional Divergence Inflows Offer A Counterweight

The United States accounted for roughly $621 million in outflows, eclipsing positive flows in other key regions. Germany, Switzerland, and Canada logged combined inflows exceeding $140 million, and Brazil and Australia added further support. These moves reveal that non-U.S. investors tend to use price downturns as entry points, especially when broader monetary conditions remain uncertain but not hostile to digital assets.

In Asia, activity was muted but not entirely negative. Hong Kong saw minor redemptions, while other markets in the region maintained relatively flat flows. The resilience outside the U.S. underscores the strategic mindset among managers who view the asset class as a long-term allocation rather than a speculative trend that hinges solely on short-term headlines.

Altcoins Gain Traction Amid Bitcoin Outflows

Ethereum drew over $205 million in inflows, led by leveraged products that point to confidence in upcoming protocol upgrades and the expansion of staking yields. Solana added more than $156 million, while XRP gained nearly $74 million, with both benefiting from recent ETP launches and continued infrastructure development. Smaller inflows into Cardano, Chainlink, Sui, and Litecoin reinforced the idea that diversification within digital assets remains active.