TL;DR

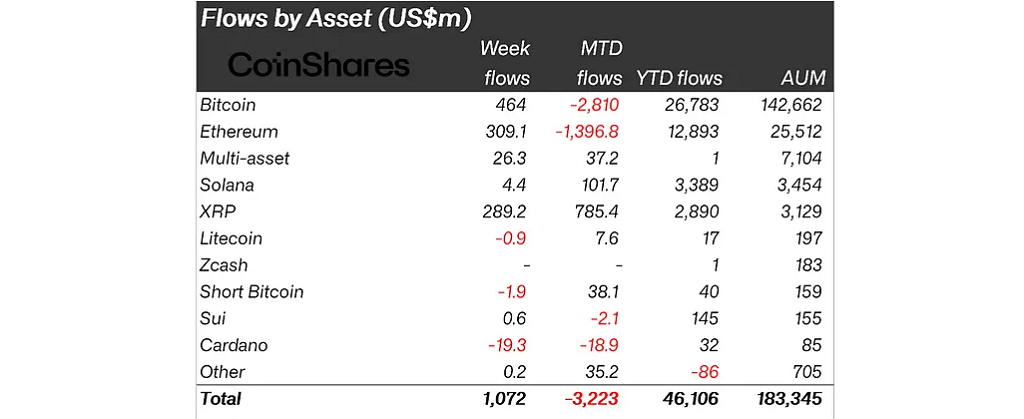

- Digital asset investment products attracted over $1.07B in weekly inflows, ending four consecutive weeks of outflows.

- The United States contributed $994 million, reinforcing its role as the main driver of institutional demand.

- Bitcoin, Ethereum and XRP led the recovery, with XRP achieving its strongest weekly inflows on record, signaling renewed appetite for large-cap exposure.

Institutional demand for digital asset funds returned with strength as global inflows surpassed $1.07B during the past week. The rebound followed a month marked by substantial withdrawals and reflects a clear improvement in sentiment tied to the macro backdrop in the United States. Investors increased exposure to Bitcoin, Ethereum and XRP, while demand for short-oriented strategies continued to decline.

Rebound In Digital Asset Funds

The recovery gained traction after comments from Federal Reserve officials noting that monetary conditions remain restrictive, raising expectations of a near-term rate adjustment. Trading volumes in exchange-traded crypto products slowed to $24B during the Thanksgiving period, yet institutional desks continued allocating capital into regulated vehicles.

The United States dominated with $994 million in new inflows. Canada added $97.6 million, and Switzerland contributed $23.6 million, while Germany reported $57.3 million in outflows, one of the few markets still holding a defensive stance. North America remains the central engine of institutional activity, with major issuers absorbing most of the renewed demand.

Bitcoin And Ethereum Lead The Charge

Bitcoin products attracted $464 million as investors reduced bearish exposure, evidenced by $1.9 million withdrawn from short-bitcoin vehicles. The shift indicates renewed confidence after several weeks of cautious positioning. Ethereum followed with $308 million, supported by stronger derivatives activity and anticipation around upcoming institutional offerings tied to the asset.

XRP delivered an unprecedented $289 million, its largest weekly inflow on record. Over the past six weeks, inflows represent 29% of total assets under management, highlighting its growing relevance among institutional allocators. Cardano posted $19.3 million in outflows, nearly a quarter of its AUM, reinforcing weakening demand for mid-cap alternatives.

Solana added $4.4 million and continues to build consistent momentum this year. Its month-to-date inflows exceed $100 million, strengthening its position as the preferred high-throughput network for institutions.

Broader Market Signals Support The Rotation

The increase in Bitcoin and Ethereum inflows aligns with stronger liquidity across exchanges and deeper participation from professional traders. Despite the holiday-driven slowdown in ETP turnover, derivatives markets show rising open interest and more stable funding rates, suggesting a healthier and more balanced trading structure.