The nature of blockchain technology will eventually lead to investors fully adopting decentralized exchanges (DEX) instead of centralized exchanges. Once we reach a point where DEXs are improved technologically the crypto community will not need Binance, Coinbase, Kraken, and others. But what do we do until that point and how does the industry deal with DeFi ‘Frankensteins’?

The Frankenstein’s monsters I am talking about are the recent influx of liquidity farming projects. While their mechanisms and concepts are a subject worthy of an article of its own, what I want to discuss is the necessity to create prerequisites for listing them.

Currently, most DEX exchanges such as Uniswap allow users to list any token they want. At some point, scammers maliciously used the decentralized feature to list fake tokens representing real projects. While that problem is now solved with token lists, there still remains the issue of listing.

I agree, decentralization as the pillar of a DEX platform should entirely allow every participant to list all kinds of tokens. But where is the border between decentralization being beneficial, and to the other end, being harmful?

The recent Ether dump resulted in many DeFi cloud chasers becoming bag holders of dubious and useless yield farming projects. At this point, it becomes a question of ethics whether to protect investors or leave them to their own. My proposed solution? Governance systems combined with auditors and utility tokens.

Decentralized Autonomous Organizations as the cure

Compared to centralized exchanges, DEX offers a seamless experience with listings that lack requirements and listing fees. Moreover, these exchanges have no mediator. Their inherent problem only appears when traders adopt DEXs and start misusing them. With several recent food-named projects that require no mentioning, we saw investors being careless and locking themselves in a hole they cannot get out of. As the English proverb says, what goes around comes around.

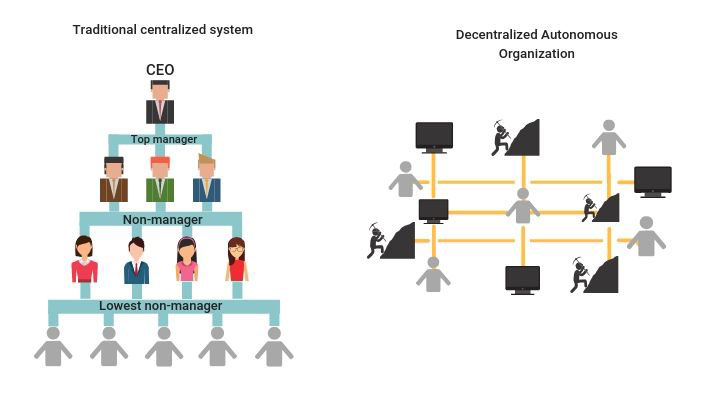

These pyramid schemes are detrimental to the market and could push retail adoption years away. A Modus operandi with which we can solve this issue is through the use of Decentralized Autonomous Organizations (DAO). DAOs represent a form of organization within which digital rules are embedded through code. These rules are entirely managed and voted by the members of a DAO, not by a centralized entity.

DEX platforms could potentially integrate the feature and create a DAO where users can spend governance tokens to vote for auditors. Ruminating on this, I imagined a 3-way system comprised out of three auditor companies that are voted into their position by users. Further on, the three entities could be replaced at any point by another auditor company as long as the community reaches a consensus.

Once in place, the auditor companies can serve a function of authority by approving listings based on the tests they conducted. Every week, users could vote with their governance tokens on project listings. Developers could propose their tokens to the community as well.

Source: Nirolution

The listing process

Let’s say that the DEX community successfully voted for five projects which entered the final list. The 3-way system previously described now consists out of the following leading blockchain auditing firms: Certik, OpenZeppelin, and Quantstamp. The DAO now requires these firms to produce an auditing report with maximum due diligence. Later on, they publish them on a public blockchain network.

Based on their imaginary results, let’s say that three out of five DeFi projects had no major vulnerabilities. Governance token holders can now freely vote on whether all five projects should pass the listing process or only the other three. The community has the full liberty to decide the fate of these projects while mindfully taking into account the auditing results. After another round of voting ends, the DEX can finally list the tokens.

While this is an oversimplified representation of how the concept would work, it still showcases the basics of how DeFi could grow in a healthy way. Why should we allow scams congest the Ethereum network, forcing everyone to suffer $40 gas fees? Furthermore, why should we allow new and inexperienced traders to fall prey to whales who manipulate DeFi projects?

Wouldn’t this take too long?

Auditing takes a long time and the entire voting process would take even longer. However, this is the price of basically forcing the market to mature. There is no more time to allow euphoric market manias like the ICO craze of 2017. If cryptocurrencies want to reach mainstream adoption, the market will need to mature. For the market to mature, investors as the main frontline have to mature first. A bull run can’t last less than a year like in 2017 or 2019. We should help the market reach a healthy and more importantly sustainable growth.

I urge you to take a look at the situation from the perspective of a parent. Would you let your child run around freely and take whatever they want without any supervision? Reaching maturity is hard and decentralization does not help, at all. A simple form of supervision at the start is all you need for the market to succeed. In my opinion, DAOs are the most decentralized version to do exactly what we need.

If you found this article interesting, here you can find more Blockchain and cryptocurrency news