For a veteran crypto investor who has seen the results of 2017’s ICO craze, the current DeFi bull run is history repeating itself. High gas fees, projects that increase five times in size in only a week, and ‘meme’ projects are just some of the few problems that are present again in 2020. In that regard, how sustainable is the current bull run and when will we see the DeFi bubble finally pop?

Yield farming surfaced this summer as a revolutionary mechanism that would solve the liquidity problem and establish higher decentralization. Platforms decided to incentivize investors to turn their assets into collateral and reward them by handing out higher returns. Moreover, yield farming quickly evolved as platforms started to give both yields and governance tokens. These governance tokens would increase many times over in value due to high demand.

The explosion of DeFi

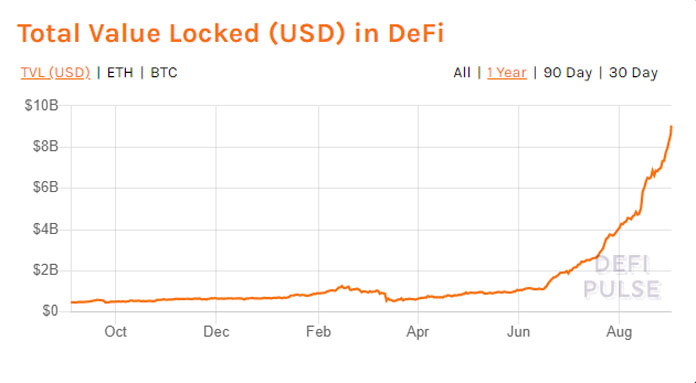

The yield farming development combined with the rise of decentralized exchange Uniswap resulted in a DeFi boom. Data from DeFi Pulse shows that the Ethereum ecosystem completely changed in only a few months. Starting in June, investors locked only around $1 billion into the sector. Today, the Total Value Locked (TVL) of DeFi reached a record high of $9.03 billion.

Among the leading DeFi projects are respectable giants such as Aave, Maker, and Uniswap. However, numerous products that provide nothing else than yield farming plague the sector. Essentially, their projects are based on investors adopting the platform in the hopes of profiting from it, much like most MLM and pyramid schemes today.

There is no value behind ‘meme’ projects such as Yam.Finance, Spaghetti, and today’s SushiSwap. SushiSwap is nothing more than a Uniswap DEX fork with higher rewards yet it reached $150 TVL five hours after launch. Despite the lack of real-world value, they are still somewhat successful in attracting farmers and at least doubling their assets. The question remains, how long will this mania last? While investors, mainly whales, are profiting the Ethereum blockchain reaches a bottleneck.

Uniswap DeFi traders plagued by gas fees

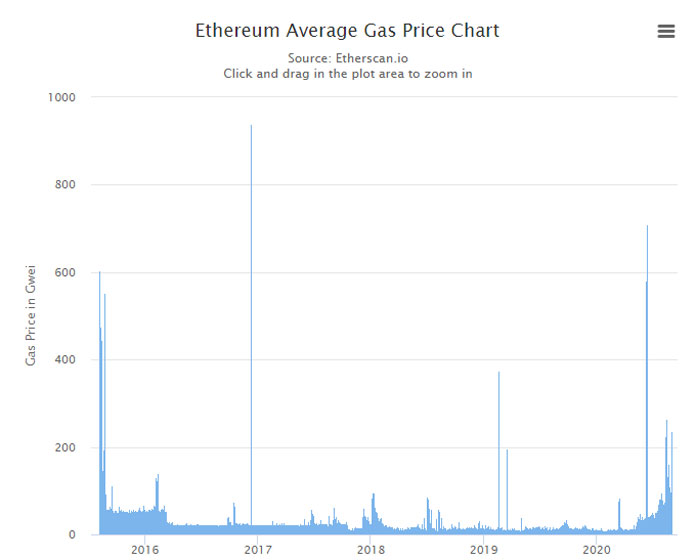

At the time of writing, Ethereum statistics platform EthStats shows that the average gas price currently ranges around 442 Gwei. While Etherscan shows a slightly better picture with 236 Gwei gas fees, we still have a glimpse at fees in the past. For the better part of the past two years, gas fees averaged between 10 and 20 Gwei.

Dollar-wise, users today pay on average between $30 to $50 per transaction. When I made a small purchase on Uniswap this morning worth $300, a gas fee of $40 in total greeted me. While it is normal for gas fees to be high during times when traders make more transactions, the issue still begs the question of how sustainable the DeFi boom is.

Investors are simply not willing to pay more than tens of percents for one small transaction. The solution to the immense fees would be ETH 2.0, but we are years away from Vitalik Buterin’s upgraded platform. Furthermore, how profitable will DeFi be when Bitcoin’s price falls several thousand dollars? It appears that DeFi is a bubble eagerly waiting to pop and most investors will not expect it.

If you found this article interesting, here you can find more Ethereum News