TL;DR

- CZ states that Bitcoin could surpass gold in market capitalization, supported by its institutional adoption and growth.

- BTC has gained 61% year-to-date, retested its long-term trendline against gold, and could reach between $130,000 and $150,000 per unit.

- The main challenge is that BTC is not yet an official reserve, but historically it has served as a hedge against inflation.

Changpeng ‘CZ’ Zhao, Binance’s founder, stated that Bitcoin could overtake gold in terms of market capitalization, a phenomenon known as the “flippening.”

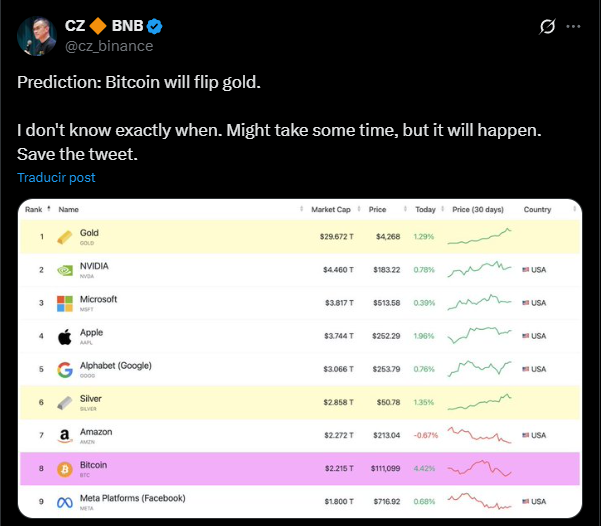

Despite gold’s rally, trading near $4,346 per ounce, BTC continues to show growth potential, with a market valued around $2.21T. According to CZ, Bitcoin’s historical expansion and strong institutional adoption position it to close the gap with the precious metal.

Does CZ’s Prediction Make Sense?

Year-to-date, BTC has gained 61%, slightly above gold’s 60.7%, and has temporarily outpaced silver as the fastest-growing asset, though this depends on regional factors. Technically, BTC has retested its long-term trendline against gold, regaining strength and reinforcing the potential for a new price range. Analysts estimate that BTC could reach $130,000–$150,000 per unit if momentum continues and the historical correlation with gold holds.

Bitcoin’s main challenge versus gold is that it is not yet considered an official reserve, and government holdings are limited. However, BTC has demonstrated its ability to hedge against inflation and volatility in traditional currencies. Its annualized historical performance has outpaced gold several times. Both assets move in relation to M2 money supply growth, meaning nominal prices do not always fully offset inflation.

The Historical Correlation Between Bitcoin and Gold

Historically, gold peaks have preceded BTC rallies. After the 2020 market crash, for example, Bitcoin climbed to $60,000. At the end of 2024, BTC partially closed the gap with gold, and it is currently once again on track to reduce the difference. Market expectations indicate that while the odds of an immediate “flippening” are low, BTC continues to send bullish signals and could shorten the gap with the precious metal in the coming months.

CZ’s outlook is based on the combination of historical growth, institutional adoption, and correlation with gold. Bitcoin remains a highly attractive asset, with the potential to expand its market capitalization and position itself as a value alternative to the market’s most traditional asset