TL;DR

- Crypto.com faces criticism after ZachXBT revealed that the 2023 data breach exposed personal information beyond what the CEO had disclosed.

- The initial incident involved a hacker from Scattered Spider who accessed an employee’s account; other unreported breaches of greater magnitude are suspected.

- The company has faced prior regulatory sanctions and legal issues, and this case could trigger investigations into its security management and transparency with users.

Crypto.com is under scrutiny after it emerged that the 2023 data breach was more extensive than its CEO had claimed.

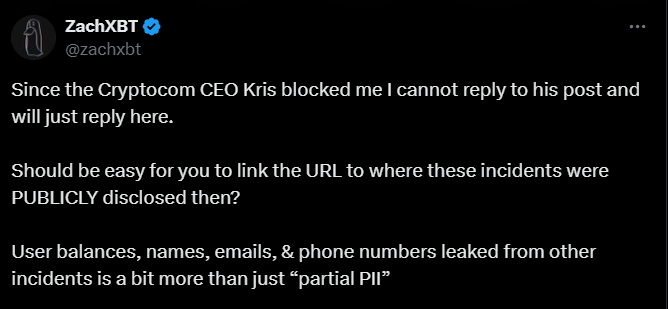

Kris Marszalek stated that the incident was quickly contained, that user funds were never at risk, and that only a very limited number of users had partial personal information exposed. However, independent investigator ZachXBT maintains that the leaked data included personally identifiable information, crypto wallet contents, emails, phone numbers, and other sensitive details, challenging the company’s official account.

According to Bloomberg, the initial breach involved a member of the hacker group Scattered Spider, who “talked their way” into a Crypto.com employee’s account using social engineering. Marszalek blocked ZachXBT on X after the investigator noted that this case is part of several unreported breaches, including a larger one for which no details have been disclosed. ZachXBT has stated that he aims to prove the leak may have led to user thefts and describes the CEO’s statements as misinformation.

ZachXBT Deals Another Blow to Crypto.com’s Reputation

Crypto.com has previously faced regulatory sanctions and legal challenges. The company received a $3 million fine in the Netherlands for operating without registering with the central bank and violating anti-money laundering and terrorism financing laws. It also faced regulatory issues in Poland and recently reissued 70 billion CRO tokens, significantly increasing the supply beyond the original 27.4 billion. Commercially, the exchange was selected by Trump Media as a partner for ETFs containing bitcoin, CRO, and other digital assets, with a $6.42 billion CRO purchase commitment.

The situation is expected to prompt further investigations and scrutiny over the company’s security practices and incident reporting. Users should always take personal security measures, especially when operating on platforms that manage high-value digital assets