TL;DR

- Over $9 billion in Bitcoin and Ethereum options expire, anchoring price near the max pain point.

- Concentration of contracts at nearby strikes makes price more sensitive to hedging flows.

- Ethereum shows a more fragile risk profile with record leverage and higher demand for puts.

Crypto markets confront one of the month’s largest options expirations. More than $9 billion in Bitcoin and Ethereum contracts expire this Friday, January 30, creating unusual pressure on price behavior at a time when leverage remains high and spot market momentum loses strength.

Bitcoin accumulates $8.3 billion in options open interest, while Ethereum adds $1.27 billion. The exposure distribution explains why BTC stays anchored near $90,000 without managing to break higher in a sustained manner.

Deribit data shows strong contract concentration between $85,000 and $95,000. The $90,000 level represents the max pain point, where most options would expire worthless. The 0.54 put-call ratio signals net bullish positioning but increasingly covered with defensive hedges.

Futures open interest remains stable according to Deribit, confirming no broad deleveraging event occurs. Exposure migrated toward options-based positions, where traders express their views through complex structures instead of direct leveraged futures.

Ethereum Shows More Fragile Structure With Record Leverage

When exposure concentrates around nearby strikes, price becomes more sensitive to hedging flows than to organic spot market demand. Market makers dynamically adjust their hedges on both sides, absorbing momentum on rallies and cushioning drops.

Binance’s 7-day net taker flow remains barely positive for Bitcoin. Buyers are present but without aggression. In previous bullish expansions, taker buy volume expanded decisively and absorbed selling pressure consistently.

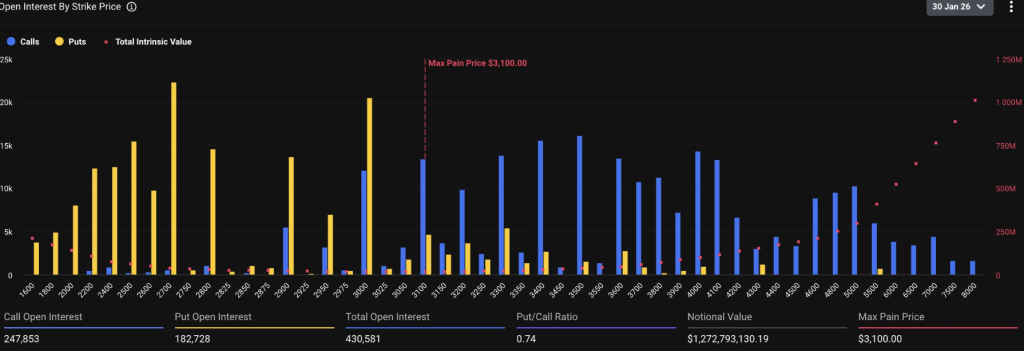

Ethereum enters expiry with a more delicate risk profile. Its put-call ratio reaches 0.74, showing higher demand for downside protection compared to Bitcoin. The max pain level sits near $3,100, while price consolidates well below its previous highs.

The options chain reveals wider strike dispersion, with notable put interest accumulating below current levels. Traders show less confidence in ETH’s ability to hold support cleanly and actively hedge against sharper bearish moves.

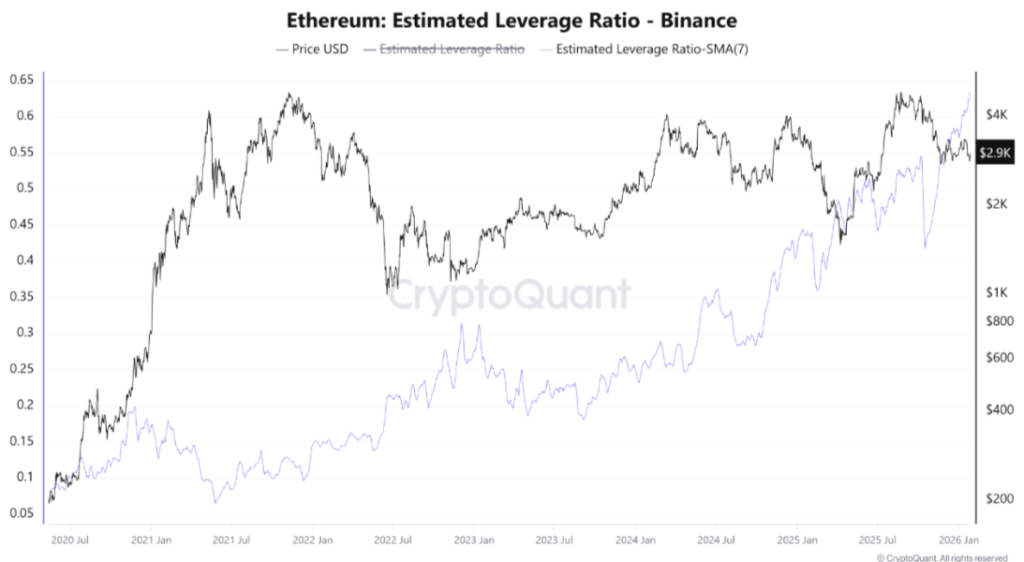

CryptoQuant reports that Ethereum’s estimated leverage ratio on Binance reached record highs. Elevated leverage is not bearish by itself, but combined with unstable taker behavior it increases the probability of abrupt price dislocations. ETH trades around $2,920 and needs to sustain above $3,080 to trigger a major short covering move.

![Is Dogecoin [DOGE] Security? Mad Money's Jim Cramer believe so](https://crypto-economy.com//wp-content/uploads/2022/01/Capture-2-300x184.jpg)