The crypto market has been trading flat over the past 24 hours as global investors and traders seem to be taking a break as the Easter weekend kicked off. Bitcoin (BTC) bulls are attempting to breach the crucial level of $28K while Ethereum (ETH) experienced a slight drop.

Long Weekend Dampens Crypto fervor

Following a price rally, the cryptocurrency market has been trading at a slower pace in the past two days. It is likely the long weekend has dampened the bubbling fervor that grasped the industry couple of days back. Although the digital assets sector has taken a slight dip, it has continued to recover significantly better after the brutal meltdown in the previous year.

The world’s largest cryptocurrency, Bitcoin (BTC) is up almost 68% year-to-date (YTD). Meanwhile, Ethereum (ETH) as well, has come back stronger following the collapse of FTX in November. In tandem with the crypto heavyweights, altcoins also soared since the beginning of this year with intermittent volatility.

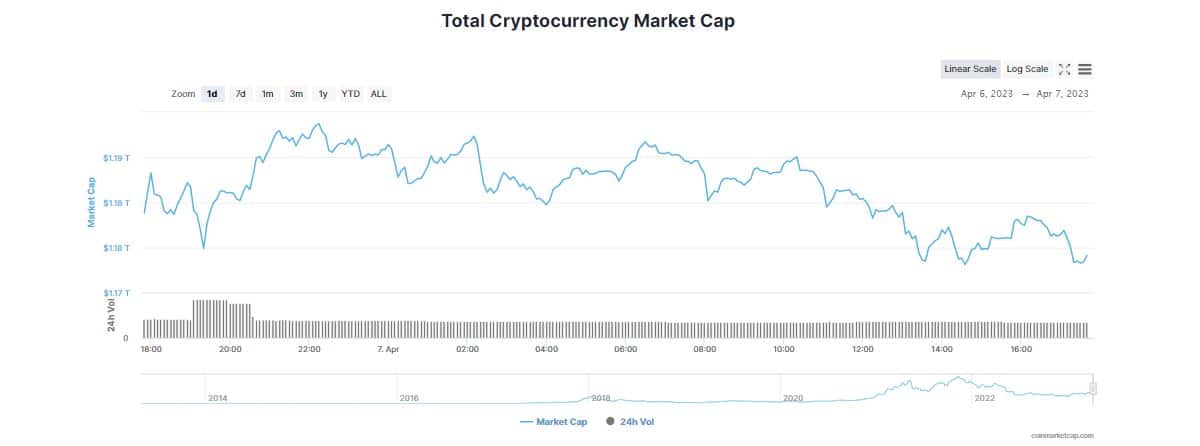

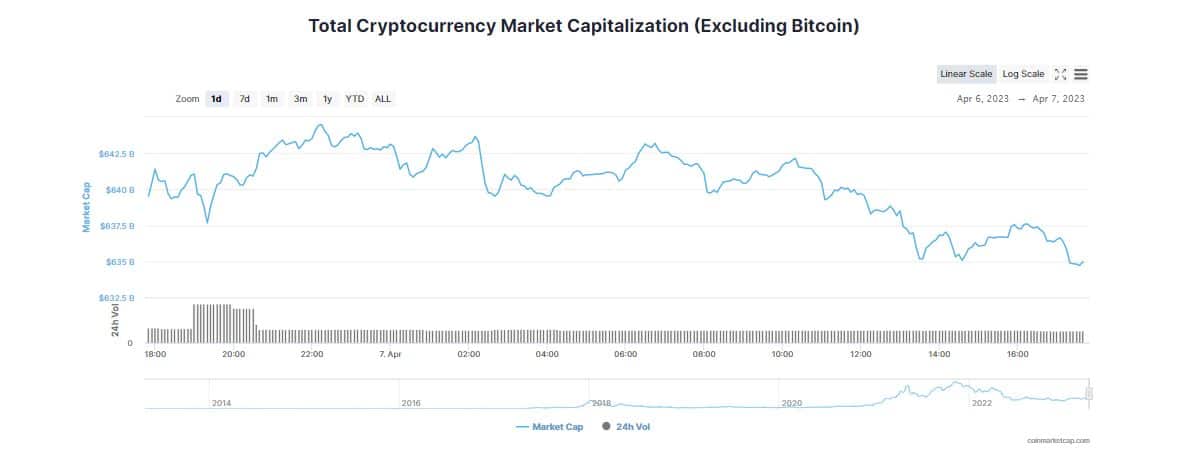

According to CoinMarketCap, the global crypto market is down 0.08% in the last 24 hours to $1.18 trillion. The total crypto market volume over the last 24 hours decreased more than 15% to 35.5 billion. Even after the marginal drop, the industry started 2023 on a positive note breaching the coveted $1 trillion mark following the catastrophic meltdown wiping billions worth of dollars from the cryptocurrency market.

This is partly because of the ongoing banking crisis in the United States and Europe. Recently, Ben Caselin, Vice President at crypto exchange MaskEX explained that with the US banking system in peril, there has been a rise in the crypto market as it has shown the world, the importance of crypto and decentralized finance (DeFi).

Bitcoin (BTC) Falls a Little

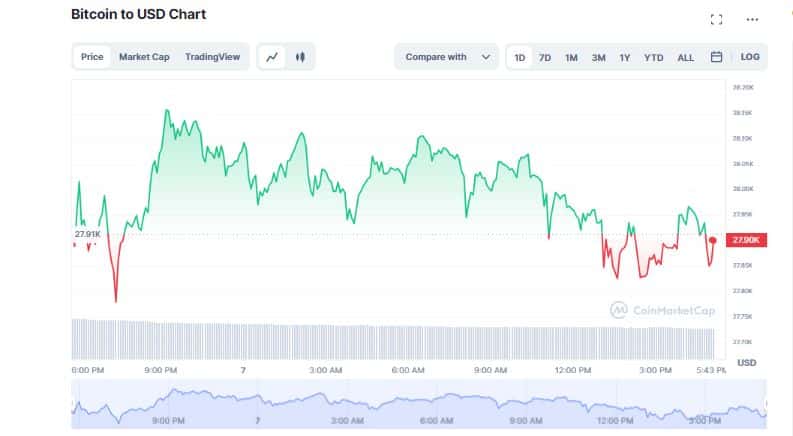

At the time of writing, Bitcoin (BTC) is down 0.02% in the last 24 hours to trade at $27,907. On the other hand, the flagship token declined by almost 0.08% over the past seven days. The price action of the largest digital asset by market capitalization remains tiresome as it oscillates within the March 17 trading range. In a statement, Edul Patel, CEO at Mudrex said,

“Despite attempts by buyers to push BTC above the crucial resistance level of $28,500, it eventually fell to US$27,800 and is presently consolidating around $28,000.”

Despite the drop, Bitcoin (BTC) has been on a bullish momentum gaining nearly 68% in this year-to-date (YTD). Last month, BTC performed exceptionally well recording better results than nearly 100% of the 500 leading publicly traded companies in the US. As per data, Bitcoin added more than $200 billion to its market cap in just Q1 of 2023, recording its best quarterly performance in almost two years. Given the upswing, Patel added,

“With instability in the banking sector, inflation data that exceeded expectations, and renewed optimism about a dovish Federal Reserve, Bitcoin has reached levels unseen in approximately nine months.”

Despite Drop ETH Holds 3% Gain On Weekly Chart

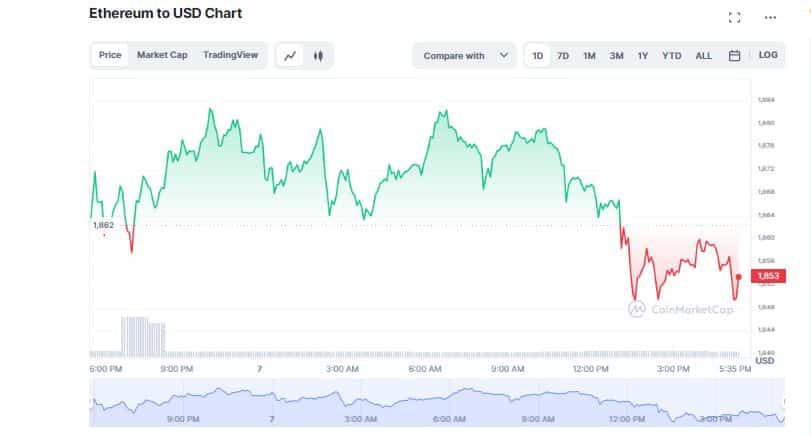

Meanwhile, Ethereum (ETH) fell 0.64% over the past 24 hours to hover at $1,853. However, over the last week, the second largest digital token pumped more than 3% as high expectations in regards to its upcoming Shanghai Upgrade, continue to propel ETH.

Several experts anticipate that Ethereum-based layer 2 blockchains will likely benefit from the network’s upcoming hard fork that will allow withdrawals from staking ETH. Max Williams, chief operating officer at Runa Digital Assets, noted the upgrade will allow developers to focus on improving users’ experience. He added,

“There’s a big benefit here coming to layer 2’s.”

Altcoins Trade in a Mix Bag

In addition, major altcoins are trading in a mixed bag. XRP prices have to continue to perform better as the legal feud between Ripple and the United States Securities and Exchange Commission (SEC) inches closer to the conclusion. At print time, XRP is up 2.35% in the last 24 hours to trade at $0.50. In the meantime, other top altcoins such as Polygon (MATIC), Solana (SOL), and Polkadot (DOT) traded with losses.

At the same time, popular meme coins including Shiba Inu (SHIB) and Dogecoin (DOGE) also traded with respective ebb and flow. SHIB traded with marginal gains of around 0.03% in the last 24 hours, while DOGE dropped more than 6%. Recently, the DOGE price grew by leaps and bounds. However, as Twitter removed the ‘Dog’ logo and restored its original blue-bird icon, DOGE emerged to be the biggest loser in the market.