TL;DR

- The Crypto Fear and Greed Index plunges to 11, signaling extreme fear amid sustained price weakness and capital outflows.

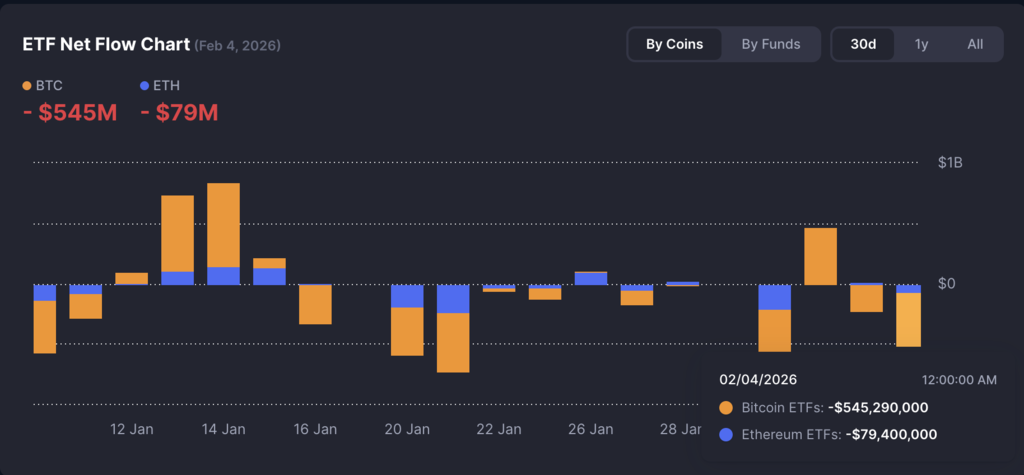

- Bitcoin ETFs see ~$545M in net outflows, indicating a shift to defensive institutional positioning.

- A key lesson from a market veteran is to HODL through crashes and aggressively average into sell-offs in secular rising assets.

Crypto market sentiment fell decisively into extreme fear, with the Crypto Fear and Greed Index dropping to 11, one of its lowest readings since late 2023. The sharp deterioration reflects a combination of sustained price weakness, rising volatility, and persistent capital outflows, reinforcing a risk-off environment across the market.

Historically, index readings below 20 have coincided with periods of elevated stress, forced selling, and broad deleveraging. Although such levels have sometimes preceded medium-term market bottoms, they immediately signal caution as participants retreat to the sidelines.

ETF outflows reinforce risk-off conditions. U.S.-listed crypto ETFs recorded heavy net outflows on February 4. Bitcoin ETFs saw net withdrawals of approximately $545 million. In comparison, Ethereum ETFs posted outflows of around $79 million, extending a trend of negative flows observed through late January.

The scale of Bitcoin ETF outflows proves particularly relevant, given that spot ETFs had previously acted as a stabilizing force during earlier drawdowns. Instead, recent data suggests institutional positioning has turned defensive, with investors reducing exposure rather than absorbing spot market selling.

Weak Price Action Fails to Inspire Confidence

Despite intermittent relief rallies, Bitcoin’s price action remains under pressure, and trading volumes have increased during declines rather than rebounds. This divergence typically reflects distribution rather than accumulation, reinforcing the fragile sentiment backdrop captured by the fear index.

Ethereum has mirrored this weakness, with ETF flows and price action pointing toward broad-based caution rather than asset-specific concerns. Altcoins, meanwhile, have underperformed relative to the broader market, amplifying perceptions of systemic risk.

What extreme fear signals for markets: Although extreme fear often attracts contrarian interest, current conditions suggest investors prioritize capital preservation over opportunistic positioning. The combination of negative ETF flows, elevated volatility, and weak price structure indicates confidence has yet to stabilize.

For sentiment to recover meaningfully, markets may require slowing ETF outflows, evidence of sustained spot demand, or reduced macro-driven uncertainty. Until then, the extreme fear reading underscores a market still searching for firm footing.

Lessons from Someone Who Lived Every Crash Since 2013

A market participant with 38 years of experience shared perspectives after witnessing every type of crash and panic. He entered crypto in 2013 buying Bitcoin at $200. After his purchase, it rose briefly then fell 75%, even during the bull market that eventually reached 10 times his entry. He did not sell because it was a long-term investment.

It fell 87% in the 2014 bear market

He suffered three declines of 35% to 45% in the bull market that followed into 2017. He eventually sold at $2,000, the previous 2013 high, due to Bitcoin forking wars. He had made 10 times his original entry. It rose another 10 times by year-end before starting another big, ugly bear.

He rebought during the Covid crash at $6,500, 3.5 times higher than when he sold. A very costly mistake. In 2021, Bitcoin fell 50% from April to July in a market similar to today. The sentiment on Twitter was horrible then. But the market was not as oversold as it is today.

By November 2021, the market was back at all-time highs. SOL rallied 13 times from its lows. ETH doubled. Bitcoin hit new highs, rallying 150%.

The first key lesson in a secular rising asset is simply to do nothing. HODL is a meme for a very good reason. It is much more powerful than the 4-year cycle meme. The second lesson was to add aggressively during selloffs, even without perfect timing, averaging into weakness to add to overall position massively compounds returns over time.

It always feels like you have missed your chance. It is never coming back. Everything will blow up forever. It is not the case.