TL;DR

- The crypto market sees a strong rebound: Bitcoin surpasses $81,500, while Ethereum, XRP, and Solana also post solid gains.

- Some analysts warn of a possible “Dead Cat Bounce,” where institutions are selling while retail investors fall into the trap of buying.

- Despite optimism driven by Trump’s tariff pause announcement, Bitcoin and Ethereum ETFs continue to register massive outflows.

The cryptocurrency market is currently experiencing a moment of euphoria. Bitcoin (BTC) has surged to $81,528.30, marking a 4.77% increase in the last 24 hours, bouncing back from its recent low of $74,500. Ethereum (ETH) has also gained 5.69%, trading at $1,578.62, while XRP has impressed with a 9.59% rise, reaching $2.01. Other top cryptocurrencies are also showing strength: Solana (SOL) is up by 6.18%, Dogecoin (DOGE) by 6.03%, Cardano (ADA) by 8.19%, TRON (TRX) by 3.32%, and BNB by 2.55%, all reflecting renewed investor appetite for digital assets.

The main catalyst behind the rally appears to be President Donald Trump’s unexpected decision to pause tariff impositions for 90 days, which has offered global markets some breathing room and temporarily restored confidence in the crypto sector.

Institutions Selling While the Public is Buying

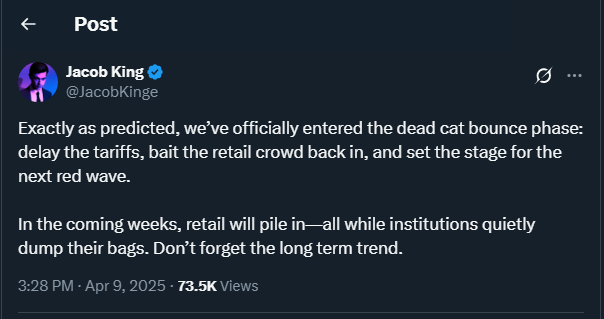

Despite the excitement, some experts urge caution. Whalewire founder Jacob King has warned that this could be a classic “Dead Cat Bounce”, a short-lived rally before another sharp fall. According to King, institutions are using the current optimism as an opportunity to exit with profits, while retail investors are jumping back in under the belief that the worst is over.

Recent figures back up this concern: US-listed Bitcoin ETFs have seen over $1 billion in outflows over the past two weeks, and Ethereum ETFs have also experienced notable withdrawals, with more than $73 million exiting. These indicators suggest that larger players may be offloading holdings ahead of a potential correction.

Long-Term Optimism and Confidence in the Technology

However, not everyone shares the pessimistic view. Some crypto analysts believe this rally has stronger foundations than previous ones, as it stems from a concrete macroeconomic move. They highlight that the crypto ecosystem has continued to strengthen in recent months, with growing institutional adoption, progress in real-world asset tokenization, and renewed interest in Web3 technologies.

Although the road ahead remains uncertain, many within the crypto community argue that volatility is a natural part of growth. Prices may fluctuate, but the underlying technology and the decentralized vision that powers cryptocurrencies continue to gain traction across the globe.